Category:Cryptoledger Applications

* To get to know our perspective at the P2P Foundation, arguing that open and contributive accounting is as important as the blockchain, see our paper on Value in the Commons Economy, by Michel Bauwens and Vasilis Niaros. What we propose is to view the emerging crypto economy through the vision of the commons and the common good, and tweak the emerging ecosystems for the commons. Global (cosmo-local) open and shared supply chains, that are designed for fair distrition of value and respect environmental limits, will need the tools of the crypto-economy. Which is why these developments are so important to us, despte their roots in hyper-capitalist ideologies.

But, for an extra word of caution against hype, read this, and this: Trust will always work better than trustless, BUT the so-called trustless mechanisms are vital for scaling cooperation at the global level.

We have extensive single pages on the pro's and con's of Bitcoin and the Blockchain, including excerpts of the main issues also in the pages Bitcoin - Discussion and Blockchain - Discussion.

Some recommended material:

- Coops Based on Cryptonetworks. Jesse Walden: "we believe that cryptonetworks — what we call “community owned and operated networks” — could unlock a new paradigm for continued cooperation, while still sustaining strong network effects".

Contextual Qoute

Blockchain consensus protocols are oligarchic in nature:

"there is not a schema that doesn’t reward those who already are already wealthy, who are already bought in, who already have excess capital or access to outsized computational power. Almost universally they grant power to the already powerful."

- Everest Pipkin [1]

"Within blockchain-based governance mechanisms, standard token voting practices rely on the neoliberal notion of “voting with your dollar.” Like the capitalist market, this means wealthy investors can simply purchase large amounts of tokens on the market in order to hoard voting power. This system allows these capitalist robber barons, or “whales” to greatly influence the outcome of proposals submitted on “decentralized” applications. In other words, financial power becomes directly correlated with political power."

- Breadchain [2]

Update

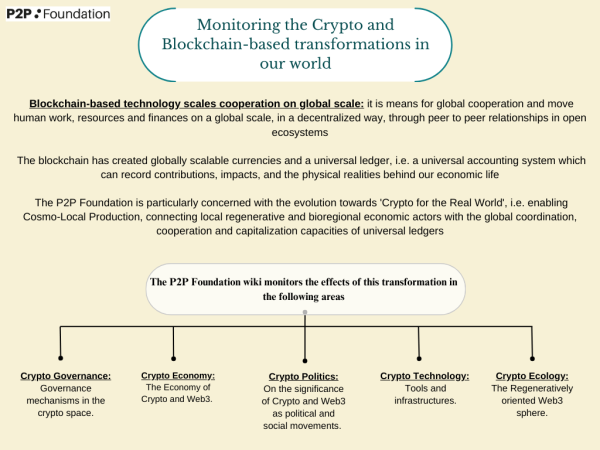

Monitoring the Crypto and Blockchain-based transformations in our world

Introduction

Joel Dietz and Primavera de Filippi:

"Cryptoledgers provide a novel way of issuing secure and tradable tokens via a distributed networks.

Although sometimes described as “cryptocurrency,” implying that the use value of the tokens is closest to currency, there are numerous other potential applications of these tokens that range from stock equivalents to previously unimaginable forms.

Although generally referred to as “cryptoequity” they can be divided into the following categories:

(1) Shares in a project that serve as a function similar to stock, allowing participation in the decision making and participation in financial upside (i.e. BitShares)

(2) Tokens which represent ownership in something other than a company, for example intellectual property (i.e. @@ are there no examples yet?)

(3) Product tokens which are redeemable for some product, perhaps one consumable in the context of a decentralized technology (i.e. Ethereum)

(4) Access tokens which provide access to a particular set of benefits within a network, similar to a membership (i.e. Swarm)"

* Article: The state of the art of co-designing digital ledger technologies for commons and common good. By Dan Diojdescu. [3]

Projects of Particular Interest to the P2P Foundation

Most crypto-ledger and blockchain applications intend to create distributed markets, which tend to oligarchic concentration over time. The P2P Foundation is partial to commons-oriented approaches in which market dynamics serve the common good and more egalitarian outcomes.

Crucial aspects to look for:

- "Programmable organizations enable production to be organized in a way that makes social criteria the rationale for production; not a constraint on it."

- "The rise of ‘networks’ as modes of corporate organization breaks down the conventional means that differentiate one corporation from another and challenges the principle of ‘competition’ as the driver of corporate rationale. These are both issues that feature prominently in decentralized applications."

- "Changes in the nature of work (precarization, casualization, subcontracting, the rise of the gig economy) see workers carrying greater risks and break down the attachment of work and living standards to employment. There is growing interest in alternative ways of organizing work."

- "The real potential is cryptocurrencies as units of account: as modes of measuring economic activity that are conceived differently from those intrinsic to fiat money. Fiat money has become tied to conventional framings of profit and loss, income and expenditure, and a market-centred calculus. Non-fiat monies have the potential for developing new ways to calculate economic activity; ways that represent different social and economic values, and measure performance by criteria other than profit. Think about it for a moment. The unit of account potential signals the importance of the crypto economy developing ways (not a singular way, but coin-specific ways) of accounting and measuring the activities supported by each token. We see this as central to giving tokens a material basis in the crypto economy; not just leaving them as speculative stores of value."

See:

1) this list of Cooperatively Minded Cryptocurrencies

2) Ten blockchain projects selected by Shareable magazine.

Generic infrastructures

Top of our list is the true peer to peer approach of the Holochain

- Will Ruddick's Credit Commons project in Kenya, aimed at extending the power of female led savings and loans clubs in the slums of Mombasa, marries the logic of complementary currencies with a crypto infrastructure which makes the whole process transparent: for details, see Sarafu Credit and the Sarafu Community Crypto-Currencies in Kenya.

Interesting projects in this sphere are:

- Commons Stack applies Ostrom-based governance principes in its design of a Crypto Commons.

- The Economic Space Agency proposes Commons-Oriented Decentralised Programmed Organisations. cDPOs "are frameworks to bootstrap, develop & sustain commons projects"., aka, the commons-oriented version of DAO's. More info in the article: Programmed Decentralised Commons Production. [8]. SenseLab is working on the 3E Process Seed Bank as a Distributed Programmable Organization which is a very similar concept to a cDPO.

- The Metacurrency Project with Arthur Brock et al. propose a Sovereign Accountable Commons which is related to their Holochain project; started with the Holo application as a first step. Follow updates here

- The FairCoop/Freedom Coop people, the creators of the Faircoin, are working on a Open Collaborative Platform, which intents to merge both open contributive accounting mechanisms and open supply chains. Check out the Resource-Event-Agent Model for supply chains that go beyond the single entreprise and can scale globally.

- The Macao cultural center in Milan uses a combination of CommonCoin, a basic income, and linkages to Faircoin and the Bank of the Commons to fairly reward cultural workers.

- Envienta attempts tokenize open source cosmo-local production

- the DAOStack project aims to solve collective intelligence and governance of networked production at scale, using 'holographic' consensus. It was originally billed as the successor to Backfeed.cc which came to early on the scene with its meta-token system, but this seems a lot more than that: video

- Pando from Ryhope Lab is working on a Decentralized Autonomous Licence for fully contributive content production, using contributive accounting to make sure everyone is rewarded fairy.

Regenerative Projects

- see the Reverse Mining project at regen.network: Regenerating a Carbon Drawdown Economy Through Reverse Mining and the Blockchain

- the Ostrom Contracts as proposed by David Dao.

- Terra0 "is a scalable framework built on the Ethereum network that provides automated resilience systems for ecosystems. Via instantiating a Decentralised Autonomous Organisation atop areas of land to manage them, terra0 aims to create technologically-augmented ecosystems that are more resilient."

Most Interesting Crypto Coins and Tokens

- Duniter is a french Open Money project that follows the Relative Theory of Money and has a Basic Income built in. It's G1 currency is probably the first truly democratic cryptocurrency in existence.

- Faircoin is a commodity currency but tempered by democratic governance processes and social justice concerns

- SolarCoin: directly created from solar energy and endorsed by Hazel Henderson and ethicalmarkets.tv

- "In the Trustlines Network every user is acting as a bank by granting credit lines to friends they trust. This allows to issue people powered money between friends and facilitate secure payments between strangers, by sending payments along a chain of trusting friends."

- The Heyerdahl Mangrove Coin "is a digital token that represents a living mangrove tree and carbon rights. Pioneering blochain technology empowers climate action with the touch of a button". [9]

- The Civil Blockchain-Based Journalism Platform looks like a serious initiative

Discussion

Why the Bitcoin ledger is potentially so important

Brett Scott:

"Banks are information intermediaries. Gone are the days of the merchant dumping a hoard of physical gold into the vaults for safekeeping. Nowadays, if you have ‘£350 in the bank’, it merely means the bank has recorded that for you in their data centre, on a database that has your account number and a corresponding entry saying ‘350’ next to it. If you want to pay someone electronically, you essentially send a message to your bank, identifying yourself via a pin or card number, asking them to change that entry in their database and to inform the recipient’s bank to do the same with the recipient’s account.

Thus, commercial banks collectively act as a cartel controlling the recording of transaction data, and it is via this process that they keep score of ‘how much money’ we have. To create a secure electronic currency system that does not rely on these banks thus requires three interacting elements. Firstly, one needs to replace the private databases that are controlled by them. Secondly, one needs to provide a way for people to change the information on that database (‘move money around’). Thirdly, one needs to convince people that the units being moved around are worth something.

To solve the first element, Bitcoin provides a public database, or ledger, that is referred to reverently as the blockchain. There is a way for people to submit information for recording in the ledger, but once it gets recorded, it cannot be edited in hindsight. If you’ve heard about bitcoin ‘mining’ (using ‘hashing algorithms’), that is what that is all about. A scattered collective of mercenary clerks essentially hire their computers out to collectively maintain the ledger, baking (or weaving) transaction records into it.

Secondly, Bitcoin has a process for individuals to identify themselves in order to submit transactions to those clerks to be recorded on that ledger. That is where public-key cryptography comes in. I have a public Bitcoin address (somewhat akin to my account number at a bank) and I then control that public address with a private key (a bit like I use my private pin number to associate myself with my bank account). This is what provides anonymity.

The result of these two elements, when put together, is the ability for anonymous individuals to record transactions between their bitcoin accounts on a database that is held and secured by a decentralised network of techno-clerks (‘miners’). " (http://furtherfield.org/features/articles/visions-techno-leviathan-politics-bitcoin-blockchain)

Vitalik Buterin of Ethereum: What I believe

Vitalik Buterin:

"Particularly, consider some of the following claims, all of which I believe in, but which are in many cases a substantial departure from the philosophies of many other people and projects:

- I do not think that weak subjectivity is all that much of a problem. However, much higher degrees of subjectivity and intrinsic reliance on extra-protocol social consensus I am still not comfortable with.

- I consider Bitcoin’s $600 million/year wasted electricity on proof of work to be an utter environmental and economic tragedy.

- I believe ASICs are a serious problem, and that as a result of them Bitcoin has become qualitatively less secure over the past two years.

- I consider Bitcoin (or any other fixed-supply currency) to be too incorrigibly volatile to ever be a stable unit of account, and believe that the best route to cryptocurrency price stability is by experimenting with intelligently designed flexible monetary policies (ie. NOT “the market” or “the Bitcoin central bank“). However, I am not interested in bringing cryptocurrency monetary policy under any kind of centralized control.

- I have a substantially more anti-institutional/libertarian/anarchistic mindset than some people, but substantially less so than others (and am incidentally not an Austrian economist). In general, I believe there is value to both sides of the fence, and believe strongly in being diplomatic and working together to make the world a better place.

- I am not in favor of there being one-currency-to-rule-them-all, in the crypto-economy or anywhere.

- I think token sales are an awesome tool for decentralized protocol monetization, and that everyone attacking the concept outright is doing a disservice to society by threatening to take away a beautiful thing. However, I do agree that the model as implemented by us and other groups so far has its flaws and we should be actively experimenting with different models that try to align incentives better

- I believe futarchy is promising enough to be worth trying, particularly in a blockchain governance context.

- I consider economics and game theory to be a key part of cryptoeconomic protocol analysis, and consider the primary academic deficit of the cryptocurrency community to be not ignorance of advanced computer science, but rather economics and philosophy. We should reach out to http://lesswrong.com/ more.

- I see one of the primary reasons why people will adopt decentralized technologies (blockchains, whisper, DHTs) in practice to be the simple fact that software developers are lazy, and do not wish to deal with the complexities of maintaining a centralized website.

- I consider the blockchain-as-decentralized-autonomous-corporation metaphor to be useful, but limited. Particularly, I believe that we as cryptocurrency developers should be taking advantage of this perhaps brief period in which cryptocurrency is still an idealist-controlled industry to design institutions that maximize utilitarian social welfare metrics, not profit (no, they are not equivalent, primarily because of these)."

(https://blog.ethereum.org/2014/12/31/silos/)

The Players

Vitalik Buterin:

"There are a number of developers and researchers who are either working for Ethereum or working on ideas as volunteers and happen to spend lots of time interacting with the Ethereum community, and this set of people has coalesced into a group dedicated to building out our particular vision. Another quasi-decentralized collective, Bitshares, has set their hearts on their own vision, combining their particular combination of DPOS, market-pegged assets and vision of blockchain as decentralized autonomous corporation as a way of reaching their political goals of free-market libertarianism and a contract free society. Blockstream, the company behind “sidechains”, has likewise attracted their own group of people and their own set of visions and agendas – and likewise for Truthcoin, Maidsafe, NXT, and many others." (https://blog.ethereum.org/2014/12/31/silos/)

Key Resources

- see: The Overview of Crypto Infrastructures, by Alexander Lange, with map

Key Articles

- Open Source in Cryptocurrencies and Token Projects, by Peter Van Valkenburgh:

- The best article I have seen so far about the socio-political impact of the Blockchain: No Gods, No Masters, No Coders? The Future of Sovereignty in a Blockchain World. By Sarah Manski and Ben Manski. Law Critique (2018) 29:151–162 [11]

- Potential of Cryptotokens as Innovative Units of Account

- Trust by Computation in the Bitcoin and Blockchain Model

- A Legal Framework For Crypto-Ledger Transactions. From Primavera De Filippi. [12]

- Blockchain technology as a regulatory technology: From Code is Law to Law is Code. By Primavera De Filippi, Samer Hassan. First Monday, Volume 21, Number 12 - 5 December 2016 [13]

- The Role of Metadata and the Blockchain in Open Supply Chains for Distributed Manufacturing. By Orestes Chouchoulas.

- Bitcoin and the Blockchain Are Firmly Anchored in Anarcho-Capitalist Visions of a Hyper-Capitalist Society ;

- Most Cryptoeconomics Do Not Challenge Neoclassical Premises

- Gleb Kostarev's Review of Blockchain Consensus Mechanisms [14]

- see here for the propertarian-libertarian view of the Crypto Commons, by Mike Maples

Key Books

- Blockchain and the Law: The Rule of Code. By Primavera De Filippi and Aaron Wright. Harvard University Press, 2018

Key Statistics

- 97% of all bitcoins are held by 4% of addresses [15]

Quotes

"Bitcoin and blockchain was invented by libertarian computer scientists. Libertarians (who should really be called Propertarians) dislike the state. With bitcoin they successfully demonstrated that machines (computers/algorithms) can function as trusted third parties in economic transactions. The state isn’t needed. The majority of the bitcoin/blockchain community is libertarian and/or profoundly pro-capitalist in outlook. They are blind to the essential act of theft that is at the heart of capitalist property relations. So much of the energy of the community is focused on making existing property relations more efficient."

- Ian Wright [16]

"Exchange is often between parties of unequal power, so mutual gain cannot be presumed. An important issue of the crypto economy is how blockchain can and cannot countermand asymmetrical power in trade. We see blockchain not facilitating frictionless markets but rather frictionless capital: distributed capital."

- Dick Bryan [17]

Vinay Gupta on the Four Waves of the Crypto Economic Revolution

"Getting crypto built into the web browsers and into the infrastructure of the Internet was the first stage, and the thing that enabled ecommerce. It was probably the single largest transformation that we’ve ever seen in terms of mass consumer adoption of cryptography. Cryptography built into Web browsers is the thing that created multiple trillions of dollars of value in the form of the entire ecommerce ecosystem, and then the Web 2.0 ecosystem that survives on advertising largely driven by ecommerce. All of that was cryptography; prior to the building of the crypto into the Web browsers there was no ecommerce, there were no credit card transactions online, there was really nothing but documents. So, we’ve already gone through one almost industrial revolution in real-world asset trading driven by crypto. The second huge transformation was the creation of SIM cards. SIM cards and bank cards that have chip and PIN and all the rest of these kinds of things were the first real large-scale adoption of hardware cryptography, that was when we started having cryptographic algorithms embedded in chips, which gave you a completely new kind of security. Then, the next turning point, the third, is the Bitcoin whitepaper. ... Finally, in the fourth step, Ethereum made it possible to run decentralised applications on the blockchain, making NFTs and DeFi possible. "

- Vinay Gupta [18]

- How the Resistance to Crypto Created More Innovation

"As crypto has developed, there have also been waves of resistance. In the 1990s, with the advent of PGP, the US government freaked out and reclassified cryptography as munitions. They literally said that encryption was armaments, and it became illegal to export from America without a licence under what was called the ITAR [International Traffic in Arms Regulations] regulations. ITAR drove a huge number of cryptographers out of America and a lot of those folks wound up in a place called Anguilla and formed an early crypto island community there. That’s also where you began to see the hybridisation of offshore finance in cryptography, and some people would suggest that that was where you got the birth of some of the stuff that became crypto economics that we started in the late 1990s.

One of these waves of resistance led to the fall of E-gold in 2005. E-gold was a perfectly reasonable gold-backed digital currency system: fully centralised, no real use of crypto, it was a very successful platform. You could transfer $100,000 from one cell phone to another cell phone in the late 1990s for 50 cents, instantaneously, and that was all gold-backed, it was essentially gold-backed stablecoins. That system was effectively shut down in 2005, when the FBI raided its offices over E-gold’s use in criminal activities and confiscated its equipment and files. I would say that almost everybody thinks that the fall of E-gold was the thing that triggered Bitcoin. It was a case of if there was going to be another E-gold and it was not going to get shut down by the government, then it was going to have to be decentralised. The response from the crypto community to E-gold, was Bitcoin and the blockchain, and that led to what we now know as the whole cryptocurrency space."

- Vinay Gupta [19]

Treating the Economy as Software

"One of the most fascinating opportunities about the rise of smart contracts is, that we now have accessible tools to efficiently engineer economic incentives in a cheap and scalable manner, thus democratizing mechanism design. This is truly powerful as, by distilling (crypto) incentives into code, we are now able to treat economics simply as software — allowing us to quickly prototype, beta test and iterate on “economies”.

- David Dao [20]

The Blockchain is a vehicle for the total transactionalization of life!

"On the one hand, they are a very powerful agent towards the “transactionalization of life”, that is of the fact that all the elements of our lives are progressively turning into transactions. Which overlaps with the fact that they become “financialized”. Everything, including our relations and emotions, progressively becomes transactionalized/financialized, and the Blockchain represent an apex of this tendency. This is already becoming a problem for informality, for the possibility of transgression, for the normation and normalization of conflicts and, thus, in prospect, for our liberties and fundamental rights, and for our possibility to perceive them (because we are talking about psychological effects). On the other hand, they move attention onto the algorithm, on the system, on the framework. Instead of supporting and maintaining the necessity and culture of establishing co-responsibility between human beings, these systems include “trust” in procedural ways."

- Salvatore Iaconesi [21]

From a DAO to a DPO, i.e. a Distributed Programmable Organization

"The Distributed Autonomous Organization evolves toward the Distributed Programmable Organization. Post-blockchain architectures are already emerging that have even more flexible, lower-cost, rhizomatic architectures operating on the peer-to-peer model. These make it possible to design alternative models embodying an ethos of sustainable economic and social cooperation that is integrally built into the systems architecture at all levels.

These developments open new possibilities for collective projects to invent their own self-sustaining creative economies, operating not in competition with each other but in a shared, open-source environment based on notions of the “common”."

- SenseLab [22]

Encoding the neoliberal subject (methodological individualism)

"What kinds of subjectivity do we want to algorithmically inscribe into our systems? Blockchain start-ups begin from the assumption that there is no trust and no community, only individual economic agents acting in self-interest. Fair enough, you might think, it’s precisely the fact that projects like Ethereum engineer confidence and provide economic incentives for contribution that may distinguish it from other services like Freenet. But it also proceeds from a perspective that already presumes a neoliberal subject and an economic mode of governance in the face of social and/or political problems. ‘How do we manage and incentivise individual competitive economic agents?’ In doing so, it not only codes for that subject, we might argue that it also reproduces that subject."

- Rachel O'Dwyer [23]

Pages in category "Cryptoledger Applications"

The following 200 pages are in this category, out of 627 total.

(previous page) (next page)A

- Abundance Protocol as a Prosocial Coordination Protocol for the Planet

- ACChain

- Accounting Blockchain Coalition

- Accounting for Cryptocurrency Climate Impacts

- Affordances of Blockchain Technologies With Regards To Commons Governance

- AgriLedger

- AgUnity App

- Akasha Foundation

- Alchemy

- Alex Grintsvayg on the CABIN Globally Networked City

- Alexandria Decentralized Library

- Algo-Robotic Systems

- Algorithmic Central Bank

- Aligning Cryptocurrency Incentives To Finance Positive Externalities

- Altcoins

- Andy Morales Coto and Ruth Catlow on Going Beyond the Blokechain

- App Coins

- Aragon DAO Framework

- Aragon Network Decentralized Court Service

- Arcade City

- Arthur Brock Against the Consensus on Data Consensus in the Blockchain

- Arthur Brock and Jean Russell on Initial Community Offerings

- Artists Thinking about the Blockchain

- Ascribe

- Asset Germination Event

- Augmented Forests

- Autonomous Decentralized Peer-to-Peer Telemetry

- Autonomous Public Goods Funding

B

- Backfeed

- Backfeed, the Blockchain, and Value Systems in the Sharing Economy

- Bancor

- Basic Income Co

- Basis

- Belgian Blockchain and Cryptoassets Federation

- Bioregional Blockchain

- Biotech DAO

- BitCloud

- Bitcoin

- Bitcoin - Business Aspects

- Bitcoin Alternatives

- Bitcoin and the Blockchain Are Firmly Anchored in Anarcho-Capitalist Visions of a Hyper-Capitalist Society

- Bitcoin as Distributed Right-Wing Extremism

- Bitcoin Mining and its Energy Footprint

- Bitcoin Scaling Debate

- Bitcoin Software as Right-Wing Extremism

- Bitcoin's Use of Purpose-Driven Token Commons as Incentive Mechanism for Network Actor Coordination

- BitHouse

- BitHub

- BitNation

- BitShares

- Bitshares Music Blockchain

- Block Chain Access Project

- Blockades

- Blockcerts

- Blockchain

- Blockchain - Discussion

- Blockchain 4 Humanity

- Blockchain and Economic Development

- Blockchain and Society Policy Research Lab

- Blockchain and the Distributed Reproduction of Capitalist Class Power

- Blockchain and the Law

- Blockchain and Value Systems in the Sharing Economy

- Blockchain Application Stack

- Blockchain Applications Directory

- Blockchain Applications for Agrifood

- Blockchain as a Blueprint for a New Economy

- Blockchain as a Tool for Radical Imagination

- Blockchain as an Alternative Institutional System to the State

- Blockchain as Blueprint for a New Economy

- Blockchain as Institutional Technology for a Commons Economy

- Blockchain as Solution for Transparency in Supply Chains

- Blockchain as Ultracapitalist Enclosure

- Blockchain Bank

- Blockchain Certificates

- Blockchain Commons

- Blockchain Companies

- Blockchain Company

- Blockchain Consensus

- Blockchain Consensus Mechanisms

- Blockchain Constitutionalism

- Blockchain Cryptography and the Commons

- Blockchain Developer Assistance

- Blockchain for Satellites

- Blockchain for Scaling Climate Action

- Blockchain for Science

- Blockchain for Social Impact Coalition

- Blockchain Governance

- Blockchain Governance and Social Contract Theories

- Blockchain Government

- Blockchain Government - Europe

- Blockchain ID

- Blockchain Imperialism in the Pacific

- Blockchain Interoperability Alliance

- Blockchain Ledger

- Blockchain Leftism

- Blockchain Network

- Blockchain Oracles

- Blockchain Proofs

- Blockchain Property Rights Project

- Blockchain Radicals

- Blockchain Revolution

- Blockchain Technologies Corp

- Blockchain Technology for Land Registries

- Blockchain Technology, Trust and Confidence

- Blockchain Through the Lens of Philosophy

- Blockchain Transportation Applications

- Blockchain Voting

- Blockchain-Based Commons Organizations

- Blockchain-Based Corporate V-Networks

- Blockchain-Based Crypto-Networks as the New Platforms

- Blockchain-Based Decentralized Financial Systems

- Blockchain-Based Decision Platform

- Blockchain-Based Digital Identity Providers

- Blockchain-Based E-Voting Systems

- Blockchain-Based Government

- Blockchain-Based Ride-Sharing Platform

- Blockchain-Based Virtual Nations

- Blockchains and Sustainable Development

- Blockchains and the Crypto-City

- Blockchains as the Neoliberal Chains of Empire in Puerto Rico

- Blockcypher

- Blocknet

- Bonding Curves

- Bot Club

- BreadChain

- Breadchain Cooperative

- Brendan Miller

- Brett Scott Interviewed on the Internet of Agreements

- Brett Scott on Stablecoins and Central Bank Digital Currencies

- Brooklyn Microgrid

C

- Cabin DAO

- Can Distributed Ledger Technology Digitally Unite Commoners

- Capturing Value Through Protocol Innovation

- Carbon Removal Market

- Carbon Sequestration-Based Cryptocurrency

- Cardano

- Carla Reyes on Technology-Specific vs Technology-Agnostic Law for Blockchain Regulation

- Categorization of Decentralized Autonomous Organizations

- Ceptr

- Chamapesa

- Checkoin

- Circles

- Civic Ledger

- Civil Blockchain-Based Journalism Platform

- Climate Chain Coalition

- Co-Designing Digital Ledger Technologies for Commons

- COALA

- Code Running Itself

- Coexistence of Decentralized Economies and Competitive Markets

- CoFi

- Coinsense

- Collaborative Blockchain-Based Data Systems in the Food Supply Chain

- Colony

- ComChain Blockchain for the Commons

- Commons Economy Roadmap

- Commons Engine

- Commons Stack

- Commons Stack Initiative

- Commons-Oriented Decentralised Programmed Organisations

- Community Staking

- Community Token Economies

- Comparison of Blockchain-Based Technologies for Implementing Community Currencies

- Complex Adaptive Dynamics Computer-Aided Design

- Computer-Aided Governance

- Computing Ledgers and the Political Ontology of the Blockchain

- Conceptual Implications of Legal Bots for Future Blockchain Infrastructure

- Confidential Distributed Ledger Transactions

- Consensus Algorithms in Public Blockchains

- ConsenSys

- Considering the Bitcoin Digital Currency as a Commons

- Continuous Organization

- Convergence Alliance

- Cooperatively Minded Cryptocurrencies

- Coops Based on Cryptonetworks

- Coorganisms

- Corda

- Cosmos Blockchain

- Counterparty

- Crypto Academy Federated Wiki

- Crypto and Blockchain Economics Research Forum

- Crypto Art

- Crypto Asset Valuation

- Crypto Cities

- Crypto Climate Accord

- Crypto Commons

- Crypto Commons Association

- Crypto Constitutionalism

- Crypto Enlightenment and the Social Theory of Blockchains

- Crypto Fire Alliance

- Crypto Hyperstructures

- Crypto Universal Basic Income Projects

- Cryptocommons

- Cryptocurrencies Linked to Renewable Energy

- Cryptocurrency for Digital Art

- Cryptocurrency Research Group

- Cryptocurrency-Based Basic Income

- Cryptocurrency’s Energy Consumption Problem

- Cryptoeconomic Primitive

- Cryptoeconomic Primitives