PART TWO: COGNITIVE CAPITALISM

This entry is about "Network Society and Future Scenarios for a Collaborative Economy" co-authored by Vasilis Kostakis and Michel Bauwens. The scholarly book is published by Palgrave Macmillan and here you may find a draft of it.

Want to read the ebook (mobi/epub)?

You may contact the authors at kostakis.b AT gmail.com and/or michel AT p2pfoundation.net.

<=Previous part || Next part=>

Cognitive capitalism refers to the process by which information (data, knowledge, design or culture) is privatized and then commodified as a means of generating profit for capital. In this new phase of capitalism, traditional processes of material production and distribution are overtaken by the control of information as the driving force of capital accumulation (see only Boutang, 2012; Bell, 1974; Drucker, 1969; for a critical analysis, see Webster, 2006). Of course, we should be aware of Federici's and Caffentzis' remark (2007, p. 70) that notions like 'cognitive labor' and 'cognitive capitalism' represent 'a part, though a leading one, of capitalist development and that different forms of knowledge and cognitive work exist that cannot be flattened under one label'. In general, one could argue that capitalism, in the past, was primarily concerned with the commodification of material. Essential to this process was the gradual enclosure and privatization of the material Commons, including pasture lands, forests, and waterways that had been used in common since time immemorial (for an analysis of the 1700-1820 enclosure in England, see Neeson, 1993). In our time, capitalism entails the enclosure and commodification of the immaterial: knowledge, culture, DNA, airwaves, even ideas (for an account of the 'second enclosure movement', see Boyle, 2003a). Ultimately, the driving force of capitalism in our age is the eradication of all Commons and the commodification of all things. The colonization and appropriation of the public domain by capital is arguably at the heart of the new enclosures. This process is sustained and extended through the complex and ever evolving web of patents, copyright laws, trade agreements, think tanks, and government and academic institutions that provide the legal, policy, and ideological frameworks that justify all this (for a critical perspective on strict intellectual property see only Lessig, 2004; Boldrin and Levine, 2013; Patry, 2009; Bessen and Meuer, 2009). Above all, the logic of this process is embedded in the values, organization, and operation of the traditional capitalist firm.

In the new vision of cognitive capitalism, which represents this book's second competing value model, networked social cooperation consists of mostly unpaid activities that can be captured and financialized by proprietary 'network' platforms. Social media platforms almost exclusively capture the value of their members’ social exchange, and distributed labor, such as crowdsourcing, tends to reduce the average income of the producers (for an overview of crowdsourcing's labor markets, digital labor and the dark side of the Internet in general, see the collective book edited by Scholz, 2012). The 'netarchical' (meaning, the hierarchies within the network which own and control participatory platforms) version of networked production, here, creates a permanent precariat and reinforces the neoliberal trends. Projects such as the P2P currency Bitcoin and the Kickstarter crowdfunding platform are representative examples of more distributed developments which embrace the idea that 'everyone can become an independent capitalist'. Under this model, P2P infrastructures are designed to allow the autonomy and participation of many players, but the main focus is still profit-maximization. Next we deal with the two forms of the neo-feudal model of cognitive capitalism (left quadrants), which are based on various technological regimes dependent on the structure of every project's back-end. User-oriented technological systems generally have two sides. The front-end is the side that users interact with, and is the only side visible to them. In other words, it is the interface with the other users and with the system itself. The back-end, however, is the technological underpinning that makes it all possible. This is engineered by the platform owners and is invisible to the user. Hence, a front-end which enables a P2P social logic amongst users can often be highly centralized, controlled, and proprietary on the back-end; forming an invisible techno-social system that profoundly influences the behavior of those using the front-end, by setting limits on what is possible in terms of human freedom. As we will see in chapters 4 and 5, a truly free P2P logic at the front-end is highly improbable if the back-end is under the exclusive control and ownership. This part concludes with chapter 6, where the potentialities of this value model are discussed.

Netarchical capitalism

The period since the 1990s saw the birth of a mixed regime. Civic internetworks (systems of interconnected networks) became increasingly available to a wider population, and other forms of networked value creation became possible. Use value has been created independently of the private industrial and financial system, through different forms of peer production and networked value creation. This creative process has taken place in the form of civic contributions, where immaterial use value is deposited in common pools of knowledge, code and design. In 'pure' peer production, this immaterial value is contributed and deposited into common pools by voluntary or paid contributors. The for-benefit associations, such as the Free/Libre Open Source Software (FLOSS) foundations, enable the continued cooperation to occur; and entrepreneurial coalitions of mostly for-profit capitalist enterprise capture the added value in the marketplace. For example, the case of the International Business Machines corporation (IBM) and Linux is well-known and widely discussed (see Tapscott and Williams, 2006; Coleman and Hill, 2004; IBM, 2010). This coalition shows how a firm entered the FLOSS ecology and invested monetary and human capital (improving the reliability of Linux by testing code, error handling, and so on) in the development of FLOSS. IBM, according to its corporate report (2010), holds significant roles in a large number of FLOSS projects such as in the development of the Linux Kernel, Apache, Eclipse or Ubuntu, working closely with Red Hat, a leading distributor of the Linux enterprise. On the one hand, IBM's involvement enhanced the quality of the outputs and the sustainability of the projects, creating chances for wage labor for some of the most active and skillful Linux developers in the market economy. On the other, the rewards from such an involvement have been considerable for IBM. According to Tapscott and Williams (at least at the time of their writing in 2006) the firm would spend about $100 million per year on general Linux development. So if the Linux community produces use value of $1 billion (if it was to be produced by paid labor), and even half of that is useful to IBM, then the firm gains $500 million of software development for an investment of $100 million (Tapscott and Williams, 2006). 'Linux gives us a viable platform uniquely tailored to our needs for twenty percent of the cost of a proprietary OS' says Cawley, IBM's business development executive at that time, in Tapscott and Williams (2006, p. 81). To put the matter bluntly, IBM would pay $2 to 10 employees but would get a value of >$20 by many more than 10 contributors, from whom a considerable number would participate on a voluntary basis. In this model, there is continued creation of use value in the public sphere and, thus, an accumulation or a circulation of the Commons based on open input, participatory processes of production, and Commons-oriented output. However, the accumulation of capital still continues through the form of labor and capital in the entrepreneurial coalitions. It becomes obvious that an increasing amount of voluntary labor is extracted in this process.

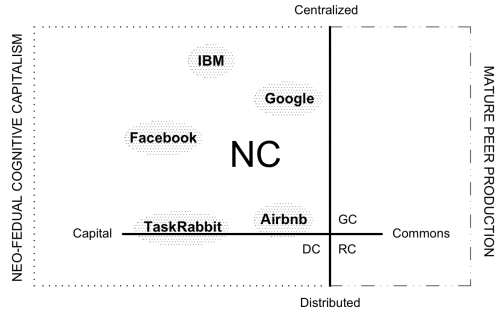

In the so-called 'sharing economies' of networked value characterized by networking processes which take place over proprietary platforms, the use value is created by the social media users, but their attention is what creates a marketplace where that use value becomes extracted exchange value. In the realm of exchange value, this new form of netarchical capitalism may be interpreted as hyper-exploitation, since the use value creators go totally unrewarded in terms of exchange value, which is solely realized by the proprietary platforms. For instance, Facebook and Google, perhaps the two bigger netarchical capitalists, abandon direct production and instead create and maintain platforms which allow people to produce. They rely much more marginally on IP protection, but rather allow P2P communication while controlling its potential monetization through their ownership of the platforms for such communication. Typically, the front-end is P2P, in that it allows P2P sociality, but the back-end is controlled. The design is in the hands of the owners, as are the private data of the users, and it is the attention of the user-base that is marketed through advertising. The financialization of cooperation is still the name of the game. The back-end of these platforms, which serve as attention pools, is generally a centralized system where personal data is privatized. The monetization of the surplus value produced is exclusionary, keeping the users/producers out of that process. Almost everything is controlled by the owners of the platforms and there is an unequal distribution of power amongst owners and users. The same applies in other proprietary platforms, such as in the case of Airbnb, a platform that helps people to rent out lodging, including private rooms, entire apartments, boats, tree houses, private islands and other properties. In other words, it commodifies things, that is, idle resources, that were not previously commodified. If one looks carefully at the back-end of Airbnb's productive structure, he/she would realize that there is neither collaborative production nor governance, and the control rests with the owners of the platform. In essence, platform owners, who are crucially dependent on the trust of user communities, exploit the aggregated attention and input of the networks in different ways, even as they enable it. In addition, such platforms are dangerous as trustees of any common value that might be created, due to their speculative nature and the opaque architecture (closed source) of their platforms (Kostakis, 2012). The parasitic nature of this mode becomes evident by the fact that an empty networking platform is arguably a valueless platform. In addition to this, search engines and social networks limit the diversity of information sources so as to please their advertising customers, potentially minimizing the development of critically-thinking citizens (Pariser, 2011). To recap, we call 'aggregated distribution' the productive models which are followed by corporations such as Google, Facebook, Airbnb or even IBM. Of course, it is important to emphasize that each netarchical project has its own special characteristics and peculiarities and it is difficult, if not impossible, to provide an all-inclusive description. However, what these projects have in common is that while their front-ends (whether the platform's infrastructure, see Facebook or Airbnb, or a P2P practice that the company may follow, see IBM) might be distributed, they are based on certain technological regimes of centralized back-ends while having a for-profit orientation with exclusionary financialization (Figure 4.1).

Figure 4.1. The netarchical capitalism quadrant

Further, in the form of crowdsourced marketplaces, capital abandons the labor form and externalizes risk onto the freelancers. Crowdsourcing economies are not very different to the sharing ones in that users still 'share' information, in a way. Compared with the sharing/aggregation economies, the profit motive for users is a bit stronger here, mainly in the form of a prize (Kostakis, 2012). Howe (2008) offers case histories such as iStockphoto, a community-driven source for stock photography, and InnoCentive, where firms offer cash prizes for solving some of their thorniest development problems. Other crowdsourcing platforms include 99designs and DesignCrowd, which both deal with design (from logo design to T-shirt design). We consider crowdsourcing projects 'disaggregated distribution', because the workers are isolated freelancers competing without collective shared IP. For instance, think of a crowdsourced logo production: the crowdsourcing company will choose the best logo out of, say, 50 logos, and the remaining 49 will often be trashed. No production of common, shared value takes place. Another typical example could be the 'skills' marketplace TaskRabbit, where workers cannot communicate with each other, but clients can. The producers are isolated as there is no connection between the supply side and the demand side. The project platform is designed to favor demand, while the network is controlled by the owners of the platform.

Under this regime of cognitive capitalism, which includes both aggregated and disaggregated distribution, use value creation expands exponentially but exchange value only rises linearly and is almost exclusively realized by capital, giving rise to forms of hyper-exploitation. We could call this value regime neo-feudal, because it often relies on unpaid 'corvée' (that is, statute labor) and creates widespread debt peonage. Ownership is replaced by access, diminishing the sovereignty that comes with property, and creating dependencies through the one-sided licensing agreements in the digital sphere. We would argue that it creates a form of hyper-neoliberalism. While in classic neoliberalism labor income stagnates, in hyper-neoliberalism society is deproletarized, that is, wage labor is increasing replaced by isolated and mostly precarious freelancers; more use value escapes the labor form altogether. Under the mixed regime of cognitive capitalism in its netarchical form, networked value production grows, and has many emancipatory effects in the social field of use value creation. However, this is in contradiction with the field of exchange value realization, where hyper-exploitation occurs. In other words, there is an increased contradiction between the proto-mode of production, which is peer production, and associated forms of networked value creation with the relations of production, which remain under the domination of financial capital.

To sum up, we define 'netarchical capitalism' as the first combination (upper-left) which matches centralized control of a distributed infrastructure with an orientation towards the accumulation of capital. Netarchical capital is that fraction of capital which enables and empowers cooperation and P2P dynamics, but through proprietary platforms that are under central control. While individuals will share through these platforms, they have no control, governance or ownership over the design and the protocol of these networks/platforms, which are proprietary. Typically, under conditions of netarchical capitalism, sharers will directly create or share use value while the monetized exchange value will be realized by the owners of capital. Whereas in the short term it is in the interest of shareholders or owners, this also creates a longer term value crisis for capital, since the value creators are not rewarded (or if they are, not in a decent way). They no longer have the purchasing power to acquire the goods that are necessary for the functioning of the physical economy.

On the one hand, in this technological regime a sector of capital has, to some significant degree, liberated itself of the need for proprietary forms of knowledge, but on the other it has actually increased the level of surplus value extraction. At the same time, use value escapes more and more its dependency on capital. This form of hyper-neoliberalism creates a crisis of value. The emergence of P2P models of production, based on the non-rivalrous nature and low marginal cost of digital information reproduction, coupled with the increasing unenforceability of IP laws, means that capital is incapable of realizing returns on ownership in the cognitive realm. In short, the creation of non-monetary value is exponential, whereas the monetization of such value is linear. There is a growing discrepancy between the direct creation of use value through social relationships and collective intelligence, but only a fraction of that value can actually be captured by business and money. Innovation is becoming social and diffuse, an emergent property of networks rather than an internal R&D affair within corporations. Hence, capital is becoming an a posteriori intervention in the realization of innovation rather than a condition for its occurrence, while more and more positive externalizations are created from the social field. What this announces is a crisis of value, most of which is 'beyond measure', but also essentially a crisis of accumulation of capital. Furthermore, we lack a mechanism for the existing institutional world to re-fund what it receives from the social world. On top of all of that, we have a crisis of social reproduction: peer production is collectively sustainable, but not individually (for an in depth examination of these correlated issues, see Arvidsson and Peitersen, 2013).

Distributed capitalism

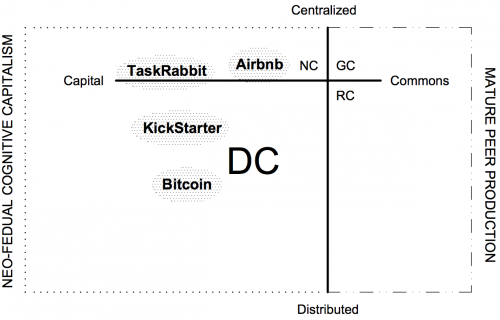

The second combination, (bottom-left) called 'distributed capitalism', matches distributed control over the back-end while maintaining focus on capital accumulation. Under this technological regime, P2P infrastructures are designed in such a way as to allow the autonomy and participation of many players. Any Commons is a byproduct or afterthought of the system, and personal motivations are driven by exchange, trade and profit. Various P2P developments can be seen within this context, striving for a more inclusionary, distributed and participative capitalism. Though they can be considered part of, say, an anti-systemic entrepreneurialism directed against monopolies and predatory intermediaries, they retain the focus on profit making. In the first scenario of netarchical capitalism, control and governance are located within a single proprietary hierarchy, whereas in distributed capitalism, control is located in the network of participating for-profit entrepreneurs and individuals. While netarchical capitalism mainly exploits human cooperation, distributed capitalism is premised on the idea that everybody can trade and exchange; or, to put it bluntly, that 'everyone can become an independent capitalist'. Of course, as we already discussed, this idea could be central to a few netarchical projects as well, such as Airbnb and TaskRabbit, which enable the monetization of small players. However, their back-ends are not distributed as with distributed capitalist projects, or in other words, in the anarcho-capitalist/libertarian projects.

The libertarian political ideology, on which many projects from this quadrant are premised, advocates the elimination of the state in favor of individual sovereignty, private property, and free/open markets (for a treatise of anarcho-capitalism, see Stringham, 2007). As the following analysis of well-known projects from this technological regime will show, the aforementioned ideology is illusionary. In theory you have equipotential individuals (that is, everyone can potentially participate in a project), but in practice what one gets is concentrated capital and centralized governance. Moreover, we see the emergence of oligarchies and aristocracies. One could postulate that the anarcho-capitalist design of this technological regime, based on the Austrian school of economics (see Schulak and Unterköfler, 2011), in many ways exacerbates the characteristics of the neoliberal era. As stated above, the P2P currency Bitcoin and the Kickstarter crowdfunding platform are representative examples of these developments.

To begin with, Bitcoin was first introduced in 2008 in a paper by Satoshi Nakamoto, which is presumed to be a pseudonym. It is basically a FLOSS (that is, part of the Commons) that supports the movement of currencies. The software circumvents banks and enables the circulation of alternative currency by exploiting P2P networks. Instead of distributing the currency through a centralized network controlled by a central bank, Bitcoins are distributed by nodes participating in a P2P network (much like the BitTorrent file sharing protocol). Further, as a FLOSS, the Bitcoin system can be monitored by all users worldwide, while participants in the development and improvement of its code cannot make changes that transcend the logic of its original design. Bitcoin is often viewed as an 'apolitical currency' (Varoufakis, 2013), devoid of the troubles that burden other currencies due to its simply being code which is controlled by no one. Yet this is not the case. Besides the fact that there are signs of emerging governance structures in Bitcoin, we can also see that its entire logic follows the key rules of other currencies. The code is in charge rather than the central banks, but as Lessig (2006) puts it, on the Internet the 'code is law', thus pointing out the politicalness imbued in each piece of software. In the real world, the law enables banks to mediate credit transactions between various parties. The law ensures the credibility of contracts, protects property rights and regulates money circulation (Lessig, 2006). Whereas in the digital world, according to Lessig (2006), the code assumes this role and defines what users can and cannot do. Therefore Bitcoin, as a piece of software, is imbued with ideas drawn from a certain political framework, as explained earlier. In other words, the P2P aspect of this project is actually not in the people, but in the computer and the code.

Moreover, Bitcoin is deliberately scarce. By limiting it to 24 million units, Nakamoto (or whoever is actually behind this project) has created a condition in which the more popular Bitcoin becomes, the higher its price gets. Of course, this makes it more and more difficult to use. The buyer will be motivated to stall any transactions to take advantage of the climbing price, while the seller, for instance an artisan, would buy material now and, by the time the final product is ready, the price would be unfavorable. In short, a deflationary currency puts pressure on the producer/seller to sell as fast as possible, while buyers prefer to wait in order to maximize their purchases. This situation clearly leads to crises. Presumably, the creators' intention was to create a currency free from debt, in the spirit of various politico-economical critiques against the credit system. Bitcoins do not come about as credit relations between two parties but rather as 'private' information in a network.

The formulation of a Bitcoin 'aristocracy' is the result of the code's architecture. Members of this aristocracy are those that got into the Bitcoin game early on, when it was easy to create new units, as well as the owners of the so-called 'monster machines', powerful computers that specialize in Bitcoin mining (Davies, 2013). This small percentage of users have accumulated a great deal of Bitcoins, thus not only exhibiting features of the credit system it is supposed to be trying to overcome, but also threatening the viability of the whole project. Our thesis is that Bitcoin is not a Commons-oriented project aiming to satisfy the needs of society, but rather a currency that inaugurates distributed capitalism. This new iteration of capitalism conforms to the characteristics of the network era and utilizes P2P infrastructures in order to achieve capital accumulation. Bitcoin is designed to allow multiple users, providing autonomy, but in a competitive framework. It might appear that it exists outside the financial system but, by promoting scarcity and competition, this project aggravates the over-accumulation of capital and exacerbates the social inequalities that it supposed to combat.

Furthermore, Kickstarter is a crowdfunding platform which enables people to pledge money to provide the means for projects to happen. If the money is raised, the project is then funded, and the people who pledged get whatever they were promised. Kickstarter functions as a reverse market with prepaid investment. In other words, it can be seen as an extension of capitalism: instead of going to the banks for money, you go to the people. According to our four scenarios approach and depending on the point of view, Kickstarter could be considered a netarchical project as well. However, since the surplus value that is extracted here comes from the P2P financing of each project, and thus, the back-end coincides with the front-end (at least from the users' perspective), we place Kickstarter in the bottom-left quadrant, although quite near to the upper-left quadrant (Figure 5.1).

Figure 5.1. The distributed capitalism quadrant

According to Bulajewski (2012), Kickstarter is actually a sophisticated web hosting provider which charges '60 times the actual cost of providing a service by skimming a percentage off financial transactions'. In other words, Bulajewski (2012) concludes, '[Kickstarter] is the very definition of parasitic capitalism'. He is not the only one who considers Kickstarter as scam, pinpointing its exploitative nature. One could find hundreds of similar allegations and critiques online, but only a few scholarly papers on the topic. Setting these accusations aside, it remains a fact that Kickstarter is nothing more than a web-hosting provider with an exchange platform and no community aspect, although it carries some interesting dynamics. This argument becomes more evident if we look at Kickstarter versus the community-oriented funding platform Goteo, whose projects must have a strong connection to the Commons. In the next part, we will address more projects like Goteo; however, it is important to first highlight the progressive aspects, if any, of the cognitive capitalist projects that were already brought to the fore. This will take place in the following chapter.

The social dynamics of the mixed model of neo-feudal cognitive capitalism

We argued that the mixed model of neo-feudal cognitive capitalism, as described through the two scenarios/technological regimes of the left quadrants, creates some untenable contradictions, such as a crisis of value. Moreover, we saw that the two scenarios of the emerging value model of cognitive capitalism share two characteristics in principle: firstly, their main aim is profit-maximization; and secondly, whatever social goods or relations might be produced are subsumed to the profit model. Hence, it becomes necessary to imagine a transition to a model where the relations of production will not be in contradiction with the evolution of the mode of production and the orientation will rest on the Commons. However, we realize that many forms of the first two scenarios are hybrid because they also allow the further growth of P2P sociality, in which media exchange and production are widely available to an ever-larger user base. For instance, platforms like Facebook, YouTube or Twitter could become a social utility. The instrumental role of proprietary social media in the success of, for example, the Egyptian anti-government protests which led to the resignation of Egypt's dictatorial leader is almost unquestionable (Eltantawy and Wiest, 2011; Khamis and Vaughn, 2011; Vargas, 2012). Or imagine a YouTube owned by filmmakers and cinemas, and an Amazon owned by authors and independent book-shops. Therefore, there are netarchical platforms that build P2P infrastructures and create some positive conditions which should be critically utilized for a more autonomous network society. Another example is the case of IBM and its coalition with various Commons-based projects in the realm of software. As already postulated, IBM profits on the use value produced through peer production processes. Nevertheless, its involvement has catalyzed the enhancement of the outputs and contributed to the sustainability of many Commons-based projects offering chances for paid labor.

In addition, moving to the distributed capitalism scenario, Bitcoin is extremely important as a signpost, since it is the first global 'post-Westphalian' currency based on 'social sovereignty'. It actually shows that alternative currencies could scale and exist as a workable alternative. Bitcoin, whether it will fail to meet its ambitious goals or not, has paved the way for a new type of currencies that utilizes new technological infrastructures, and whose dynamics should not be ignored. As discussed, Bitcoin's protocol enables a decentralized network to achieve consensus, without requiring any trust between parties. Also, the potential of its innovations (the blockchain, for instance) is so big that it has caught the attention of major banking institutions. However, we would say that the most important achievement is that it envisions an alternative approach to tackling the major problems in the current credit system. As an open source software program, Bitcoin can get upgraded and it can also get forked. We are witnessing a plethora of new digital currencies based on Bitcoin which aim to surpass some of the issues that were discussed in the previous chapter. Their efforts revolve around the belief that the current financial system is based on an unsustainable principle of continuous growth, and attempt to implement social values into their structure. Openmoney and the Open UDC are indicative of such efforts. Both projects provide the opportunity for communities to create their own alternative currencies. Peercoin, on the other hand, functions similarly to Bitcoin, but attempts to overcome its problems. Some of these currencies are based on the trust between members of a community of producers and consumers, while others allow mathematics to eliminate the concept of interest from the core of the financial system. Furthermore, crowdfunding platforms like Kickstarter have sometimes enabled the funding and the development of novel, Commons-oriented projects. For example, at the time of this writing (March 2014), more than 220 projects have been tagged as open source and a considerable number of those have been successfully funded, according to the Kickstarter website (Kickstarter, 2014).

The critical observation and documentation of the potentialities of projects placed in the two left quadrants can offer valuable lessons and opportunities for utilization. Commons-based communities can benefit from capitalist platforms while struggling for their own rights as the real value creators and, in conditions of social strength, could potentially take over such platforms as common or publicly owned utilities. Moreover, they can fork and/or utilize best practices (for example, the case of Goteo in relation to Kickstarter) and technologies (for example, the Bitcoin protocol) developed with a for-profit orientation. We propose that this can happen through the creation of non-capitalist, community-supportive, benefit-driven entities that participate in market exchange without participating in capital accumulation. Before articulating some preliminary policy proposals for such a working hypothesis, we should discuss the next two scenarios/technological regimes based on a different orientation, that of building, empowering and protecting the Commons sphere.