PART ONE: THEORETICAL FRAMEWORK

This entry is about "Network Society and Future Scenarios for a Collaborative Economy" co-authored by Vasilis Kostakis and Michel Bauwens. The scholarly book is published by Palgrave Macmillan and here you may find a draft of it.

Want to read the ebook (mobi/epub)?

You may contact the authors at kostakis.b AT gmail.com and/or michel AT p2pfoundation.net.

<=Contents and Preface || Next part=>

Capitalism as a creative destruction system

The capitalist mode of production has arguably created a political economy prone to crises. Following Harvey's vivid narration (2012, p. 5), a typical day in the life of a capitalist begins with a certain amount of money and ends with a lot more. The next day, however, the capitalist has to think about how he is going to manage that surplus capital: will he reinvest the profits or will he spend them? As long as we are not speaking about monopolies (Baran and Sweezy, 1966), the fierce competition compels him to reinvest. If he does not, a competitor certainly will. Of course, a successful capitalist profits enough to maintain profitable expansion while also living a super-luxurious life. The constant search for new terrains of growth is a premise for the sustainability of the system. Capital accumulation must expand at a compound rate: 'the result of perpetual reinvestment is the expansion of surplus production', Harvey writes (2012, p. 5). The capitalist faces a variety of problems during the aforementioned procedure. If wages are too high due to labor scarcity, for instance, fresh labor forces must be found or precarious living conditions must be artificially created, thus dropping wages, in order to keep the system in a growth trajectory. Furthermore, that new terrain of growth is enriched with the introduction of new means of production and technological and/or organizational innovations. New needs and wants are defined, distances between nation-states diminished, and the capitalist finds himself capable not only of discovering new natural resources, but also of attracting new customers (Harvey, 2012, 2010; Perez, 2002). When purchasing power cannot serve an increasingly expanding economy, new credit-based financial instruments are invented. If the profit rate is low, sometimes companies merge, creating powerful conglomerates and, therefore, monopolies. If capital accumulation does not continue, then the system falls into a serious crisis. Capitalists are unable to find profitable paths of reinvestment; capital accumulation stagnates and its value decreases. Massive unemployment, impoverishment and social turmoil are some of the potential consequences of a capitalist crisis.

But many would argue that no other economic system has produced so much wealth. On the other hand, some might claim that no other system has produced so much destruction. Others consider capitalism a creative destruction system. This book uses the theory of techno-economic paradigm shifts (TEPS) – gradually developed by Schumpeter (1982/1939; 1975/1942), Kondratieff (1979), Freeman (1974; 1996), and in particular Perez (1983; 1985; 1988; 2002; 2009a; 2009b) – as its point of departure to develop its narrative. This choice arguably helps recognize the dynamic and changing nature of the capitalist system, in order to avoid any particular period extrapolation as 'the end of history' in the fashion of Fukuyama (1992). Therefore, the aim is not to make capitalism crisis-free but to manage crises and soften blows. In other words, to form a successful 'creative destruction management' (Kalvet and Kattel, 2006), maximizing its creative power while minimizing its destructive force (Mulgan, 2013). One should be aware of many other theoretical alternatives, those of Marx for example, in understanding and acting within certain social, technological and economic processes. Interestingly, Marxist and neo-Schumpeterian theoretical approaches consider capitalism prone to crises which are basic features of its normal functioning. However, the neo-Marxist critique (see Wolff, 2010; Harvey, 2007; 2010) puts emphasis on the inherent unsustainability of capitalism, aiming at a different system – 'modern society can do better than capitalism', Wolff (2010) postulates – whereas neo-Schumpeterians, such as Perez (2002) or Freeman (1974; 1996), see crises as a chance to move the capitalist economy forward. This book is an integrative attempt at highlighting the potential of new modes of social production and organization immanent in capitalism but which, in the long term, might transcend the dominant system.

If we follow Schmoller (1898/1893), the main figure of the German Historical School, history is the laboratory of the economist. Despite the unquestionable uniqueness of each historical period in socio-economic development, the theory of TEPS accepts recurrence as a frame of reference and, having each period's uniqueness as the object of study, tries to interpret the potential and the direction of change (Perez, 2002). Moreover, it embraces the Schumpeterian (1982/1939) understanding of economy as 'an interdependent sequence of dynamic forces of change and static equilibrating forces' (Drechsler et al., 2006, p. 15). The essential fact about capitalism is the process of creative destruction incessantly revolutionizing the economic structure from within, destroying the old one while creating a new one (Schumpeter, 1975/1942). Each techno-economic paradigm (TEP) is based on a constellation of innovations, both technical and organizational, which are the driving force behind economic development (Perez, 1983). Each TEP plays the central role in a recurring pattern of cyclical movement: from gilded ages to golden ages; from an initial installation period, through a collapse and recession which signify the turning point, to a full deployment period (Perez, 2002; 2009a). Therefore, in the Perezian framework (2002; 2009a), progress in capitalism takes place by going through various successive great surges of development which are driven by successive technological revolutions. Each of these overlapping great surges of development, lasting approximately 40-60 years, is the process by which a technological revolution and its paradigm propagate across the economy, 'leading to structural changes in production, distribution, communication and consumption as well as to profound and qualitative changes in society' (Perez, 2002, p. 15).

According to the TEPS theory, the world has experienced five technological revolutions during the last three centuries: the first industrial revolution based on machines, factories and canals (initiated in 1771; birthplace: Britain); the age of steam, coal, iron and railways (1829; Britain); the age of steel and heavy engineering (1875; Britain, USA, and Germany); the age of automobile, oil, petrochemicals and mass production (1908; USA); and the age of information technology and communication (1971; USA). Each of these processes evolved 'from small beginnings in restricted sectors and geographic regions', and ended up 'encompassing the bulk of activities in the core country or countries and diffusing out towards further and further peripheries, depending on the capacity of the transport and communications infrastructures' (Perez, 2002, p. 15).

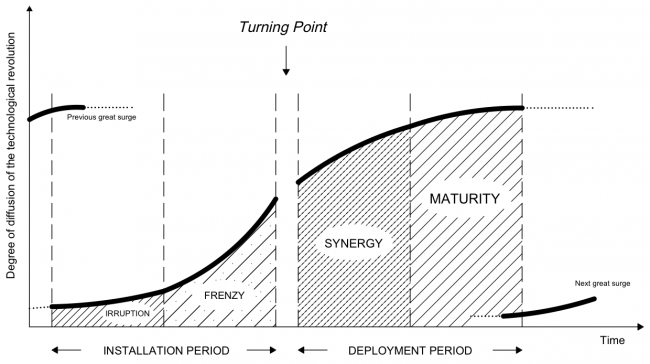

A great surge of development consists of four phases, which, although not strictly separated, can be identified as sharing common characteristics throughout history (Figure 1.1).

Figure 1.1. Recurring phases of each great surge in the core countries. Based on Based on Perez, C. (2002) Technological Revolutions and Financial Capital: The Dynamics of Bubbles and Golden Ages (Cheltenham: Edward Elgar Pub), p. 48

Firstly we have irruption (technological explosion), or the initial development of new technologies in a world where the bulk of the economy is made of old, maturing and declining industries. Frenzy follows, which is the rapid development of technology requiring a great deal of finance (this is when financial bubbles are created). These two first phases constitute the installation period of the new TEP, when finance and greed prevail and the paper economy decouples from the real one. Next, turbulent times arrive - that is, collapse, recession and instability. This is what Perez calls the turning point; neither a phase nor an event, but rather a process of contextual shift, where institutional changes for the deployment period of the newly installed paradigm take place. Institutional innovations occur, which enable economies to take advantage of new technology across all sectors, and in turn to spread the benefits of this new wealth-creating potential widely across society. These synergies appear in the early stages of deployment (synergy phase) until they approach a ceiling (maturity phase) in productivity, new products and markets. Once that ceiling is hit, social unrest and confrontations will occur while conditions for the installation of the new paradigm, based on the next technological revolution, are set.

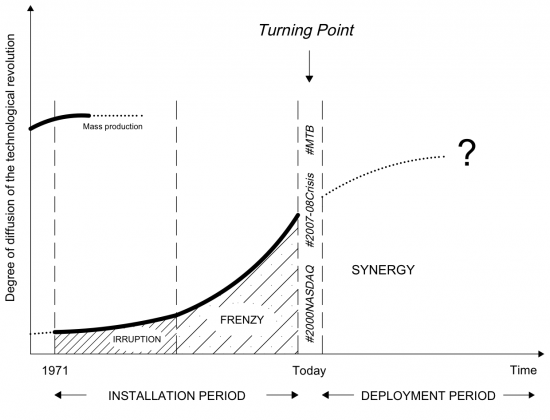

Perez (2009b) highlights the special nature of major technological bubbles (MTB), which are endogenous to the process by which society and the economy assimilate each great surge. The MTB tend to take place along the diffusion path of each technological revolution: from the installation period, when the new constellation of technologies is tested and investment is defined by the short term goals of financial capital (so a rift between real values and paper values occurs), to the deployment period, when financial capital is brought back to reality, production capital takes the lead and the state is called to make effective 'creative destruction management' (Kalvet and Kattel, 2006). Perez (2009b) argues that the MTB of the current TEP, that is the information and communications technology (ICT) revolution, occurred in two episodes (Figure 1.2).

Figure 1.2. The current ICT-driven techno-economic paradigm: The major technological bubbles at the turning point and a deployment period to come. Based on Perez, C. (2002) Technological Revolutions and Financial Capital: The Dynamics of Bubbles and Golden Ages (Cheltenham: Edward Elgar Pub), p. 48

First was the Internet mania, based on technological innovation, which ended in the NASDAQ collapse in 2000. This was followed by the easy liquidity bubble, based on financial innovations accelerated by the new technologies, ending in the financial crisis in 2007-8. The essential implication of Perez' argumentation (2009b, p. 803) is that 'what we are facing is not just a financial crisis but rather the end of a period and the need for a structural shift in social and economic context to allow for continued growth under this paradigm'. Moreover, Perez' essay (2009b) on the double bubble, aligned with the TEPS theory, is used as a point of departure that treats the current situation as not just another passing recession, and sets the ground for tentative proposals concerning the second half of the ICT revolution's wealth-generating potential.

Since the introduction of the microprocessor (California, November, 1971), and after a nearly 30 year-long paroxystic culmination of market experimentation and moments of Galbraithian irrationality (1993), we find ourselves in the aftermath of two major bubbles and, arguably, in the midst of a major capitalist crisis (Fuchs et al., 2010, p. 193). In other words, we are witnessing, as we will later see, the swing of the pendulum from extreme individualism to collective, synergistic well being. The whole system is trying to recompose (Perez, 2002), while political unrest (e.g., the EU coherency crisis triggered by the debt crisis) and protests (from the Indignados movement in Spain and the protest movement in Greece to the Occupy Wall Street movement in the USA) are erupting globally. However, this book's goal is neither to describe the strands and ramifications of the current crisis, as this has been done elsewhere (see Harvey, 2007; 2010; Chomsky, 2011; Funnell, Jupe and Andrew, 2009; Stiglitz, 2010). Nor is its goal to indicate historical parallels in previous turning points within capitalism, as Perez has done that in detail in her 2002 book. It can be claimed, though, that the two bubbles at the turn of this century recall the 1929 depression in that they share one fundamental characteristic: the structural tensions within capitalism make the system, at least in its current form, unsustainable. The world is arguably at a crossroads where the excesses, the fallacies and the unsustainability of the current practices need to be recognized; appropriate regulatory changes have to be made where the usual recipes for confronting tensions fail; and conditions where production capital is put in control, greater social cohesion is achieved, and desperation and anger turn into creation, must be facilitated (Perez, 2002; 2009a; 2009b). In other words, this turning point is a time of indeterminate realization of the full potential of the current ICT-driven paradigm, creating the new fabric of the economy and overcoming the tensions that caused this premature saturation (Perez, 2002).

Beyond the end of history: Three competing value models

Have we already lived through the end of history with the fall of the Berlin wall in 1989-90? Is the capitalist mode of production the final stage of human progress? Or are we currently living in the end times with capitalism approaching its terminal crisis? According to Žižek (2010, p. x), the dominant system is unable to face its internal imbalances and its failures: the ongoing ecological crisis as well as the emergence of new forms of apartheid, walls and slums. Capitalism transforms not because of its failures but because of its successes, neo-Schumpeterians might reply, and now it is high time we created virtuous circles of production that would allow the system to reinvent itself once again. The environmental crisis can be seen as an opportunity for investment and sustainable growth (Gore, 2013). In the meantime, a new type of capitalism, named 'cognitive capitalism', arises in which 'the object of accumulation consists mainly of knowledge' that is now the basic source of value (Boutang, 2012, p. 57). The industrial mode of production is becoming obsolete and the 'network' is the main pattern of organizing production and socio-political relations (see only Castells, 2000; 2003; 2009). Peer-to-peer (P2P) technologies and renewable energy merge, creating an energy Internet and, thus, inaugurate a third industrial revolution (Rifkin, 2011). On top of that, one may add another disruptive technological cluster, the 'Internet of Things', which could help 'humanity reintegrate itself into the complex choreography of the biosphere, and by doing so, dramatically increases productivity without compromising the ecological relationships that govern the planet' (Rifkin, 2014, p. 13). Others (see Anderson, 2012) point to emerging desktop manufacturing technologies such as the three dimensional (3D) printing, and consider them the pervasive technological cluster which will trigger a new industrial revolution. Success in taking advantage of these transformations, and, at least in theory, the benefits of new wealth creating potential will spread more widely across society.

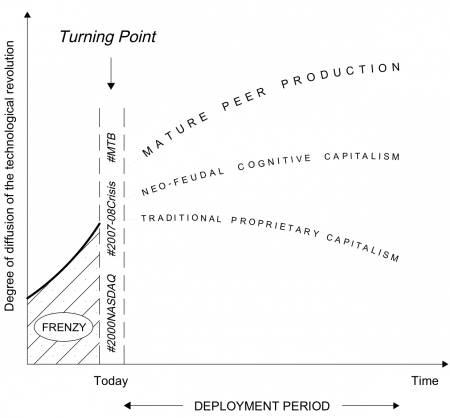

This book argues that, at the current turning point of the ICT-based TEP and within the present political economy, there are three different value models competing for dominance which influence the way institutional recompositions will take place. One form is still dominant, but rapidly declining in importance; a second form is reaching dominance, but carries within itself the seeds of its own destruction; and a third is emerging, but needs vital new policies in order to become dominant (Figure 2.1).

Figure 2.1. Three competing value models

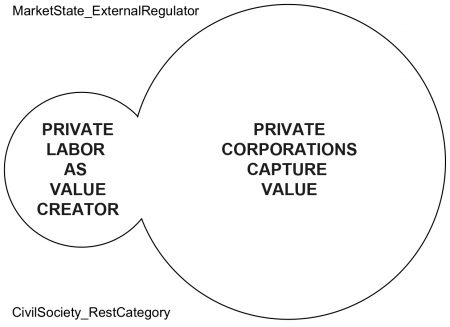

The first is the classic capitalist economy based on labor value and proprietary forms of knowledge, which dominated the industrial phase of capitalism. The value model of the traditional proprietary capitalism is based on the premise that workers create value in their private capacity as providers of labor (Figure 2.2). This value is captured and realized in the market by capital, which dominates the extraction of surplus value. In the old neoliberal vision, the state becomes a market state which protects the privileged interests of property owners; and civil society is a 'rest category' – a sphere of minor importance as is evidenced in the use of our language (non-profits, non-governmental). The de-skilling of workers—what was once artisanal production knowledge but which is now codified in the production process itself—characterizes this form. Labor becomes an appendage to the ecosystem of machines. In this division between labor and capital, managerial and engineering layers handle collective production on behalf of the owners of capital. At first, this is largely industrial capital, though financial capital rises rapidly to prominence. Codified knowledge is proprietary and value is increasingly captured as intellectual property (IP) rent. However, industrial profit, based on the direct extraction of surplus value, is the dominant form of value capture, and there is partial redistribution in the form of wages.

Figure 2.2. The value model of the traditional proprietary capitalism which dominated the first phase of the current techno-economic paradigm

Often, once a social (labor) movement takes form and becomes powerful and influential, the state redistributes taxable wealth to the workers as consumers and citizens in the form of social provisions (pensions, unemployment benefits, health care reimbursements, and so on). This happened extensively during the period 1945-80, manifested by the rise of the welfare state and Keynesian policies, especially in the western world. Since 1980, under contemporary conditions of labor weakness in the de-industrializing developed countries, the state has been redistributing wealth to the financial sector and creating conditions of debt dependence for the majority of the population. In this neoliberal format, which became dominant after 1980 before the emergence of civic peer networks in the eve of the 21st century (Benkler, 2006; Bauwens, 2005), the part of labor became stagnant and most of the value streamed towards financial capital. The credit system developed into an increasingly important means to maintain the fictitious buying power of consumers and, therefore, the primary means of surplus realization through debt dependency and servicing.

We argue that this value model of traditional proprietary capitalism, dominant in the installation period of the current TEP, is approaching its terminal point. Its inherent unsustainability is manifested in a twofold problem. On one hand, industrial capitalism considers nature to be a perpetually abundant resource; that is, it is based on a false notion of material abundance in a finite world. On the other hand, the traditional, industrial version of cognitive capitalism enforces the idea that intellectual, scientific and technical exchange should be subject to strong proprietary constraints. In that way, an artificial scarcity of knowledge is created, subjecting innovation to legal restrictions and allowing for profit maximization and, hence, capital accumulation. Thus appears the paradoxical but also dramatic contradiction of the present, dominant system: while it is rapidly overburdening the carrying capacity of the planet, it simultaneously inhibits the solutions humanity might find for it. For example, the dramatic increase in patents has not been paralleled by an increase in technological innovation: 'there is no empirical evidence that they [patents] serve to increase innovation and productivity, unless productivity [or innovation] is identified with the number of patents awarded' (Boldrin and Levine, 2013, p. 3). 'In the long run', Boldrin and Levine argue (2013, p. 7), 'patents reduce the incentives for current innovation because current innovators are subject to constant legal action and licensing demands from earlier patent holders'. The process of innovation relies upon building on former innovations. Therefore, the broader the pool of accessible ideas, the more chances there are for innovation (Brynjolfsson and McAfee, 2011). To recap, this combination of quasi-abundance and quasi-scarcity destroys the biosphere and hampers the expansion of social innovation and a 'free culture' (as described in Lessig, 2004), and this situation, arguably, must be reversed.

The recent crises have brought scholars from various traditions and schools to agree that the global economy is currently at a turning point within the ICT-driven TEP. In this book, we deal with the remaining two competing value models. These are more synchronized with the main characteristics of the current TEP, and seem to introduce less fragile alternative approaches for development in the deployment period. The second form is the neo-feudal cognitive capitalism, in which proprietary forms of knowledge are in the process of being displaced by emerging forms of peer production (Benkler, 2006; Bauwens, 2005), but under the dominance of financial capital. We will describe how this process is well under way. The third is the hypothetical form of mature peer production under civic dominance, whose stems are already emerging through the interstices of the dominant system.

The P2P infrastructures: Two axes and four quadrants

The P2P infrastructures, such as the Internet, are those infrastructures for communication, cooperation and common value creation that allow for permission-less interlinking of human cooperators and their technological aids. We argue that such infrastructures are becoming the general conditions of work, life and society (see only Bauwens, 2005). Of course, one should be aware of the danger of 'Internet-centrism' (Morozov, 2014) and the perception that the Internet is the solution to all of humanity’s problems. However, change is unlikely to occur without sufficient ICT penetration since, as has become evident, various aspects of complex human nature can be amplified and telescoped by the Internet (Mackinnon, 2012). P2P relational dynamics, which sometimes seem to epitomize the old slogan 'Jeder nach seinen Fähigkeiten, jedem nach seinen Bedürfnissen!' (from each according to his ability, to each according to his need), are based on the distribution of the productive forces. First, the means of information, immaterial production, that is the networked computers, and now the means of physical manufacturing, that is machines that produce physical objects, are being distributed and interconnected. Just as networked computers democratized the means of production of information and communication, the emergent elements of networked micro-factories or what some (see Kostakis, Fountouklis and Drechsler, 2013; Anderson, 2012; Rifkin, 2014) call desktop manufacturing, such as 3D printing and computer-numerical-control (CNC) machines, are democratizing the means of making.

Of course, this process is not without its problems. In a time of extreme polarization and with no equilibrium reached in regard to global governance of the Internet (Mueller, 2010), we have witnessed conflicts over the control and ownership of distributed infrastructures. For example, the Internet, the world’s largest ungoverned space (Schmidt and Cohen, 2013), has become a highly contested political space (MacKinnon, 2012). On the one side, peer production signals for some fundamental changes to take place juxtaposing them against an old order that should be cast off (Bauwens, 2005; Benkler, 2006). On the other, the proposed legislations of ACTA/SOPA/PIPA that enforce strict copyright; the attempts at surveillance, public opinion manipulation, censorship and the marginalization of opposite voices by both authoritarian and liberal countries (MacKinnon, 2012); and 'the growing tendency to link the Internet’s security problems to the very properties that made it innovative and revolutionary in the first place' (Mueller, 2010, p. 160), are only some of the reasons that have made some scholars (see Zittrain, 2008; Mackinnon, 2012) worry that digital systems may be pushed back to the model of locked-down devices or centrally controlled information appliances. Hence, there appears to be a battle emerging amongst agents (several governments and corporations), which are trying to turn the Internet into a tightly controlled information medium, and user communities who are trying to keep the medium independent.

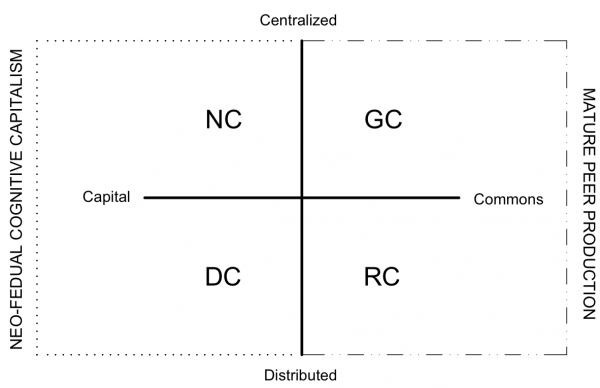

This book attempts to simplify possible outcomes by using two axes, or polarities, which give rise to four possible scenarios. Each quadrant stands for a certain scenario where each technological regime is dominant. This does not exclude the presence of the rest, however the dominant regime defines the kind of political economy which may prevail. Value regimes are more or less associated with technology regimes, since the forces at play want to protect their interests through the control of technological and media platforms, which encourage certain behaviors and logics, but discourage others. The powers over technological protocols and value-driven design decisions are used to create technological platforms that match proprietary interests. Even as P2P technologies and networks are becoming ubiquitous, ostensibly similar P2P technologies have very different characteristics which lead to different models of value creation and distribution, and thus to different social and technological behaviors. In networks, human behavior can be subtly — or not so subtly — influenced by design decisions and invisible protocols created in the interest of the owners or managers of the platforms.

The Figure 3.1 is organized around two axes, which determine at least four distinct possibilities. The first top-down axis distinguishes centralized technological control (and an orientation towards globality) from distributed technological control (and an orientation towards localization); the horizontal axis distinguishes a for-profit orientation (where any social good is subsumed to the goal of shareholder profit), from for-benefit orientations (where eventual profits are subsumed to the social goal).

Figure 3.1. Two axes and four future scenarios

The four scenario approach has been widely used as an exploratory tool that allows for fruitful discussions on policy-making (van der Heijden, 2005; Leigh, 2003) and sustainable strategic planning and development (Godet, 2000; Kelly, Sirr and Ratcliffe, 2004). Each scenario has a descriptive role and outlines tentative political economies with the aim of sparking the imagination and serving as a route map for the future (Miles, 2004). Using scenarios is like rehearsing the future, according to Schwartz (1996). By rehearsing these future scenarios, organizations, states and the civil society can adapt to what is happening and anticipate and influence what could transpire. In accordance with van der Heijden et al. (2002) and Schwartz (1996), our scenario framework consists of two dimensions which have high level of uncertainty and are crucial to future developments. The first axis presents the polarity of centralized versus distributed control of the productive infrastructure, whereas the second axis relates an orientation towards the accumulation of capital versus an orientation towards the accumulation or circulation of the Commons.

Within this context the following four future scenarios for economy and society are introduced: netarchical capitalism (NC), distributed capitalism (DC), resilient communities (RC) and global Commons (GC). Netarchical and distributed capitalism differ in the control of the productive infrastructure but both are oriented towards capital accumulation and, thus, are parts of the wider value mode of cognitive capitalism. They actually form the mixed model of neo-feudal cognitive capitalism. On the other, resilient communities and the global Commons reside in the, one might say auspicious, hypothetical model of mature peer production under civic dominance (right quadrants). The next parts shed light on each scenario in separate chapters, also discussing the co-existence of each pair of models sharing a common orientation. Moreover, the third part attempts to introduce a few preliminary general principles for policy making, and put forward some general policy recommendations with the goal of moving from the left side of the quadrants to the right. Or, to put it in the terms of the TEPS theory, to realize the full potential of an ICT-driven TEP while maximizing the benefits from technological progress for the largest part of society.