BUXXB: Difference between revisions

No edit summary |

No edit summary |

||

| Line 1: | Line 1: | ||

''' Please excuse this is a work in progress. | ''' Please excuse this is a work in progress.''' | ||

Please send any questions to swooned@gmail.com so I can be sure I cover everything I can with this article.''' | ''' Please send any questions to swooned@gmail.com so I can be sure I cover everything I can with this article.''' | ||

[[image: BUXlogo.png | center | 250px]] | [[image: BUXlogo.png | center | 250px]] | ||

Revision as of 23:59, 27 November 2018

Please excuse this is a work in progress. Please send any questions to swooned@gmail.com so I can be sure I cover everything I can with this article.

BUX (Be You Exchange), is a zero-cost exchange (ZCE) that is scalable from the size of communities to in and between nations. The concept of BUX is to shift incentives from unsustainable product manufacture and processes to sustainable ones. This also shifts what is considered as wealth, allowing people to receive what they need to create what they want, without the need of excess. It drives status from the waste of dominion and ownership creating commodities to obsolescence to the efficiency of sharing experiences to possible redundancy.

It is built solely on the basis of an exchange and has no commodity value, therefore, unlike the current ICO market, is not available for speculation in currency or commodity markets. Still in concept, the model is validated by other ZCEs such as NumeroSet and TUMIN. While these have different parameters, the core is none demand a cost, therefore are connected for testing with their differences to know what parameters outside of zero cost work best to empower the most people to have status creating sustainably.

BUX is a decentralised bank owned by all those that participate in it. This aligns with creators owning their creations to create and distribute as they wish to whom they choose. No one is forced to give their creations to anyone at anytime.

Perceptions of Human Nature

Before we establish the best currency modelling for a sustainable, empowering, and symbiotic future, we must look at believed perceptions of human nature.

There is a virtually universal belief that human nature is flawed: greedy, competitive to destruction, and needs extrinsic motivators to do something. More correct is we adapt to environment to be as efficient as possible to be successful. In that journey, we default to trusting information by our peers to facilitate this, so it is easy to trust who suggests to be fearful of. Once that seed is planted, the rest is history as we know it today. Prevalent in politics and religion, the divide and rule paradigm filters into social and economic sectors, dominating the framework of decision making.

Much of this influence in born in fear-based game theories. However impartial as game theory aims to be, the framework of the game will define the natural direction most people will react. In the prisoner’s dilemma, to suggest to trust someone who has acted on a disempowering framework would already bias the natural reaction to fear truing the other person. In contrast, trust-based games have invited much more positive responses. In either case, the parameter of scarcity v abundance, or disempowerment v empowerment, biases the decision most generic people will make. Therefore, the environment a game presents will affect the outcome. No game is truly unbiased and any stats on games must consider this aspect. The work of Dr Richard Ryan on Self-Determination Theory (http://selfdeterminationtheory.org) proves that we are far more intrinsically motivated than we allow ourselves to be. Our journey of survival in a repetitive disempowering world reinforces our judgement for increased protection, to the point where we simply can’t feel safe any more. However, anyone with children can see how trusting they instinctively are, knowing this is the best scenario for survival. It is hard to know how children would develop in a supportive creative centric world instead of where cultures increasingly are perpetually fighting for survival.

A useful currency must incentivise the empowering nature of humanity. We are all attracted to power, but the type of power manifest depends on the parameters of the game. Our diverse cultures are built around overcoming environmental challenges. Most also developed to succeed around scarcity.

Fundamentals of Money

There are many discussions on the characteristics of money, but few on the fundamentals. Money is not just the capacity to use it, but the frameworks, the parameters, that define it. What defines those parameters must be based on basic facts of exchange, wealth, and empowerment:

- Money is a medium to exchange wealth, not wealth itself. Therefore it must be a neutral exchange mechanism, not a commodity to speculate on. Its sole purpose is to exchange wealth: what we create. #If we created nothing, then money would be meaningless. Those who own money, commoditising it, ‘bank’ on the fact that we are inevitable creators. Therefore, by owning the exchange mechanism, by default own people’s creativity.

- Adding interest to money, appreciating its inherent commodity value but depreciating its purchasing power, depreciates what is created. Therefore, in the interests in exchanging sustainably, the commodity value of money must depreciate, instead valuing the purchasing power of money, which aligns to the direction of sustainable creation.

- For stability in finance, all transactions should balance. Therefore, there cannot be any fractional reserve lending. Doing such makes money a commodity.

- In free markets, currencies can be different, but their fundamentals are always the same. Nations have their own currencies, but they are all debt-based, so their parameters are the same, as they should be, to connect with each other. Therefore, in creating new local currencies that value creating sustainably, they can all be community/culturally identifiable, but the parameters will always be the same.

Currency Modelling for Sustainability

The present focus solely on human nature misses the need for an environment to its evolution to happen. It is quite obvious that, with all the fight for change we go through, predominantly through politics, little has changed.

The one constant throughout change has been and is debt-based currencies (DBCs). Therefore, this is the one area that needs more attention to for any substantiative change to take effect. Current exchange innovations do not change the parameters of currency, just change the costs within them, which changes little. They concentrate on the characteristics of currency, which are incidental to the parameters of currencies.

There are 4 basic parameters that change how people will use an exchange model:

- Amount available (finite or infinite).

- Distribution method (connected or separate from work done).

- What it is based on (tangible or not, eg gold or work).

- Costs or not (usury, demurrage, fees, taxes, or none at all).

Unlike any other commodity, money and banking the only one that has added costs to its principle. All other industries are valued on absolute pricing differences. Why this is the case is not important. That it does is. This affects the relationship to money above anything else and inherently makes all things created from it diminutive to it. It would be obvious why owning money would be so desired, but this contradicts the balance of nature, competitive as it is. As no innovation takes out this core concept, nothing much will change. BUX flips the model to afford being competitive, but working in balance as in anything created, synergy and empowerment are key to be given resources and labour for ideas to come to fruition.

ZCEs vs Bitcoin vs ICOs vs DBCs

Money has had a long history as a commodity, therefore a mechanism of wealth itself, irrespective fo what it can buy. At present, the volume of currency available over what it actually created in products and services to buy is approximately 33:1. Despite the total volume in existence, which inherently means there is a total glut of currency in the market even before ICOs, how it is distributed keeps it scarce, and therefore keeps its value. The ultimate status of measure of wealth is owning it, even though it can’t buy as much as one would like, and so becomes the tool for buying the most meaningless things for meaningless purposes which is completely unsustainable.

While we look for solutions using DBCs, we will always waste energy not only in money markets themselves but trying to control it so it is stable enough to work for the greater good. If this was possible, we would have already achieved this. Instead, political an economic dogma has aimed to finesse ways to work with the fragile monetary model using ‘innovative’ ideas of economic gurus with, at best, temporary success, only to fail again to yet find another idea to try to pull out of the black hole. All such solutions omit the one primary problem: money has costs. As it is a mechanism to exchange wealth, not wealth itself, making money on money, especially with interest, makes no sense.

ICOs

How a block chain is defined, what it offers, show how empowering it is or not. Ethereum, on which many ICOs were and are built on, is the complete antithesis of Bitcoin, offering unlimited capacity to create currency. Despite the knowledge that flooding economics with increased money supply would weaken the purchasing power, may ICOs were released and like the dot.com bust, have cycled very quickly to redundancy, taking what it could in mainstream currencies like any pyramid scheme. ICO markets did not crash mainstream currency markets because they were decentralised and in their own bubble: no one was using ICOs for exchange purposes, only for commodity.

Bitcoin

Bitcoin is unique in its specific parameters, unlike most ICOs. It has an absolute limit that cannot be breached. Many crypto currency (CC) specialists believe that its infinite divisibility makes this irrelevant but forget this means prices must drop to keep the velocity of BTC moving since its volume is finite. Stability would be reached when all coins are released and will not decrease (or until it is uneconomical to continue mining for them) and everyone solely used BTC to trade. That the volume would be stable is unlikely unless BTC was not used for any other purpose. Either way, these limitations were quite obvious and the support of Bitcoin become ridicule over how inefficient it is for trade. However, this is the short term way of looking at BTC. The first of its kind, it influenced the currency trading market to decentralise, yet connect, the building of its infrastructure, in essence issuing an ICO itself with a white paper. However, in analysing it’s parameters if used globally, it would effectively crash the price mechanism: that of higher value costs more. Of course this is why CC players were looking for something new. The point of BTC is inherently to demonstrate that price is a very primitive and old way of establishing value.

ZCEs

If a currency has any cost involved, directly or indirectly, it presents itself primarily as a commodity. Therefore the best currency model for change is one that neutralises this and dominates itself as an exchange model between wealth and cannot be commoditised as wealth itself.

In any variation of a ZCE, the core idea of one being used is to drive creating experiences, customised on demand, that empower the most people in the most sustainable way possible. The idea is to stabilise or even reduce prices for higher quality experiences as required. This keeps the purchasing power high, distributed primarily evenly, with little, if any, need to control pricing. This also allows the market to be free, as it is meant to be in capitalism, truly allowing people to access what empowers them the most without the need for ownership.

Outside of their having no cost which is fixed, varying factors include:

- If there is an amount given in reward for joining.

- If the ZCE is run with or without labour charges.

- If controlling the amount of currency in the market is separate from the amount of work being created.

- If education is credited to participants or still considered a transaction between parties.

Examples of ZCEs using these parameters are:

- TUMIN: reward on joining, volume based on work created, bank is run with volunteers, all exchanges may not always balance to zero but orbit around it.

- NumeroSet: reward on joining, volume available based on velocity of exchange, bank run with volunteers,. all exchanges balance to zero.

The parameters of BUX are a little different:

- Ideally no reward on joining, but can convert exisiting work and educated life to BUX.

- Volume based on work created.

- Base rate of $60p/h is mean point for any service or product creation, as free market demands

- Participants in running bank are paid on base rate (base point is $60p/h)

- Time spent in education credits all participants as peers, therefore all earn something for participating in education

- Total volume of money available and prices are disconnected from each other

The forecast of using BUX is that prices inversely fall inversely to increased quality as projects that support the best use of resources will only be supported. Governance demands making what these projects are, analysing their qualitative effects to a factor of synergy = empowerment / sustainability (Sn = E/Ss).

Those projects that have the highest factor naturally value all resources available for the greatest outcome. How this is calculated is dependent substantially by location and numbers in the community, therefore to ascertain an exact figure is not relevant. More pertinent are comparisons, and what people really want to do. There is no point telling people to do the most sustainable thing if there is no joy doing it. This would make it unsustainable by default. What ultimately happens is economics is governed by qualitative measures, such as creativity and empowerment instead of quantitative measures that are dominant, and therefore disempowering, in DBCs.

Parameters of BUX

BUX is a specific ZCE that dominates the trusting part of human nature without compromising our competitive nature. It capitalises on using a competitive free market, but also incentives collaboration as the most effective way to create the best for the most people. It does not take away the autonomy of business, but does take away it's current sustainable waste of resources. It changes the cultural aspect of business from its culinary backstabbing nature to a sport, learning from competitive collaboration to be better together for a new day while also valuing what is created as art.

To facilitate trade without the inherent disempowering nature of DBCs, BUX can be called anything a community wants to call it, but as the parameters can be considered the same across communities, it will be BUX named to identify the community/country that uses it, and what specialties, if any. Unlike communities using DBCs that would trade currencies between them, this is redundant in BUX as the only difference could be the price from other communities that could make buying outside one's community more advantageous.

BUX is, at the risk of sounding generic, a people's bank. It cannot be owned by a specific entity as all money created is by the people themselves. It is simply a ledger as there is no commodity in owning the currency, so it doesn’t. There is nothing in the bank unless people choose to value their work being paid in it. Participants running the bank base their work on the set mean payment as all other participants using BUX. Given that this could, however unlikely, be a problem as all people are using the bank, the $60p/h is the ceiling price, although it can drop as mean pricing changes with more people using the bank.

This also means there is no need to loan money, or influences a political model that demands tax for projects. All projects, large or small, that is supported is chosen by the community, not governance, based on the qualitative frameworks of Sy.E/Su. This makes the community the centre decision maker for what goes ahead, and not servant to an economic model to keep them busy or its own sake. Growth creating commodities is pointless. Growth creating experiences is evolutionary.

It is a blockchain database built on Holochain. Any data used from this will only demonstrate what projects are being supported and why. Therefore, there is no need to secure this, but everyone has a right to show or hide any data they choose.

A crucial framework in BUX is that there is no incentive whatsoever to use resources destructively, as commodity does. Therefore, anything that involves any inefficiency, such as war, can't be supported. There is no incentive to own resources to warrant such conflict as resources will flow to those who use them best: to those who create the best experiences that empower the most people in the most sustainable way possible.

Whatever are the best parameters to use, they will blend between ideas that TUMIN, NumeroSet, and BUX are working with, as their objectives are the same: to drive status creating sustainably. Already the comparison between these defines the competition between them: it doesn’t matter who wins because all will benefit with the best model in action.

There are many other currency models out there for social good, but most are connected in some way to DBCs. While this may be more acceptable to change makers, analyses of their full affects has to be explored in detail. Examples aim to put prices on the environment, which would be an extraordinarily hard thing to do. How does this change over time? How does it balance with what is created and the economics to sustain it? The term social good, and qualities over quantities, have been thrown around exhaustively as much as discussing sustainability vs regeneration when both point in the same direction, so why bother arguing between them when they are aligned. Given the history of how much time has been spent fighting for sustainable change, that none attack the parameters of currency show how fundamental these have to be addressed for anything substantial to happen.

Implementing BUX

There are certain fundamentals that will change across all applications of BUX, with different trajectories that afford change for the better. I will look at macro effects then micro situations to see how they all fit together.

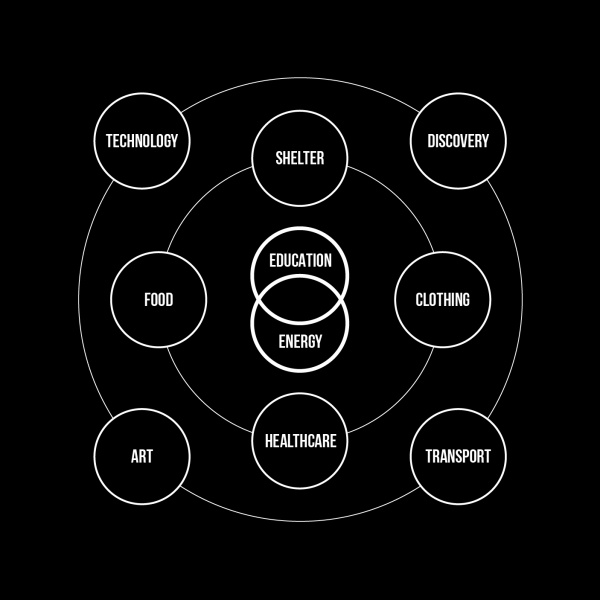

There are core industry orbits that are ubiquitous in any social structure: food. clothing, shelter, tech, healthcare, and transport. To scale these are 2 core centres: education and energy. Anything else is subject to how empowering, or disempowering, these cares are managed.

The effects of these using DBCs in managing these is quite obvious in how they have been so destructive to Earth. It can be considered that all cycles, economical and societal, have been created by using DBCs. This is why changing the exchange model to a more empowering model use can have such a huge impact.

DBCs are inherently disempowering as they are built on fear-based game theory of human nature. This is why DBCs and power-based politics work together; fear is an easy sell to limit the reactions of people which makes that easy to decipher and act on. Both are built on corruptive foundations, delusions of grandeur, and power over others. This is also why many industries not only exist, but are bloated, in assisting with the compromise, such as:

- banking

- defence

- religions and cults

- insurance

- anti-trust

- sensational media

- advertising and public relations

Using BUX, the energy required running these sectors is reduced substantially, if required at all. The requirement to becomes moot. Using DBCs leads to compromises in ethics: not knowing whose to follow, and being caught, again, in the status of finding a solution, not effectively applying them. As BUX promote efficiency empowering all aspects involved, the ethic becomes creating excellence for self and all, which respects all people involved by default. Therefore, oversight to create excellence, what DBCs profess to achieve yet must be surveilled continuously, becomes virtually redundant.

BUX may have no cost, but the effects of such are anything but stagnant. Wealth is based on what is truly created, not an imaginary construct, and this is its strength.

Creating and Scaling New Communities

Using Dunbar’s number as a reference, 150 people would be selected to cover the 6 sectors of 25 people each. incorporated in that would be participant who owns a farm.

- The food sector will work on transforming the farm to a sustainable food forest.

- The clothing sector will connect with utilise growing hemp to make clothing on demand.

- The shelter sector will also be using hemp, mud, timber, glass, and stainless for tiny houses.

- The tech sector will be accessing and creating networks to share information, exchanges, and social profiles showing what people want to do and what is out there to make, based on the Synergy formula, as required.

- The healthcare sector will look at creating the best remedies and inventory for any ailments or accidents, as required.

- The transport sector will deign and put forward systems for the most efficient accessible transport systems for all these networks to work together in the most efficient way possible.

All these sectors design the space together for the most efficient ways to create these systems based on their expertise. All sectors also reach out to DBC markets to offer their expertise to be paid in BUX instead of DBCs as well as been fine any surplus stock. . This reduces the liabilities of participating industries, increasing profit margins to then pay off debt faster. Further, with access to an increasing number of people willing to be paid with BUX, there is an incentive to access expertise with less and ultimately no need to use resources from DBC markets. As this is happening across sectors, not just one, there will be little compromise in shifting to BUX as product and services in BUX markets expands. What is made will also change as commodity based markets will shift to experience based markets, which will create quite different, but for more, empowering, things to access.

Liaising With Existing Industry and Communities

As in creating new communities connecting with BUX, the key is to offer support to DBC connected communities with resources and labour paid in BUX. The advantages for their integrating BUX and then leaving DBCs to such companies are obvious.

Decision Making within the Commons

Much of commoning decision making focuses on highest ethical capacity. The dilemma is this focuses a lot on underprivileged at the expense of creators who could use available resources far more efficiently, to the benefit not everyone, including the underprivileged. This offers a means of inclusion for all involved regardless of any socio-political stigmas. This values the ethics of creating excellence, to the greatest capacity possible.

The Exponentials: Forecasting Effects in the BUX Network

BUX is not a model to drive subsistence or austerity paradigms. Its objective is to drive creative capacity as efficiently as possible in synergy with Earth and even the universe. it drives the qualitative nature of value, therefore the love that gamchangers speak of, but not in an ethical space where love itself can be owned, but in the excellence space, where, as in what you create and make, cannot be owned by anyone else, as is your value in BUX itself.

Commodities v Experiences

Wealth through commodities implies status, and security, through quantities. While people do sell the experiences with owning such commodities, specifications are shortly superseded, with status becoming having the latest of its type over the knowledge and efficiency in how to use them.

Wealth through experiences values status, and security, through qualities. People value creating empowering experiences in exchange for the same by others, encouraging customising what is created on demand. This values efficient, and symbiotic, use of resources and labour. There is no value owning an experience, but more in having access to it.

Obsolescence v Redundancy

The meaning of words always changes with cultural differences. Like the word usury has been covertly changed to mean exorbitant interest on money when it actually means any interest on money, so has obsolescence inherently implies it is planned as our emphasis of value has become universally connected to commodity. As the emphasis here is to buy experiences with as little value as possible, commodity values wanting more not less, thereby disempowering those who buy them.

To totally disassociate with this connection, redundancy implies anything created has past its need to be created, superseded by something else after the learning experience of that creation is past. As the objective of creating experiences to redundancy is to empower as much as possible, creating in such a way is the most sustainable path to follow. BUX promotes this way valuing what is created with as little governance as possible.

==Resource Dominion v Resource Efficiency== or Quantitative v Qualitative Dominion

There is a long standing tradition for the need to own property as security to create, especially in modern economic models. Greatness was and is usually politically driven, not just by owning land, but also by owning people to work it. The book ‘Debt: The First 5000 Years’ by David Graebar effectively illustrates the relevance of war and dominion to create monetary wealth. This also shaped systems where people can create their own wealth, but still built on smaller version of the same effects: owning someone and something to create what one wants. This is turn has affected the whole social structure we have built to be empowered, compromising something somewhere.

Commoning has little value dominion through ownership, but dominion through efficiency. It is the use of land to empower the most people that offers the reputation and status that people desire. By default, sustainability and collaboration become the standards in creating everything in this economy. It is all about the quality and experiences. This is the strength that BUX offers to these empowered communities.

Entrepreneurship

Banking & Finance

Funding

Politics

Defence

Insurance

Crime

Racism & Minorities

Mental Health

Public Relations, Marketing & Advertising

Journalism & Media

Innovation

Artificial Intelligence

Philosophy

Emergence

Evolving Work Dynamics

Urban Transformations

Objective v Subjective Motivation

Ownership of Self Empowerment

Mental Health

Ownership of Community Empowerment

Manifestation of Power

Status

Efficient Use of Energy

BUX and the Price Mechanism

BUX v DBCs at Scale

Actions

Further Reading

https://medium.com/@buex http://www.numeroset.net https://www.holochain.org https://topdocumentaryfilms.com/consumed/ https://en.wikipedia.org/wiki/Debt:_The_First_5000_Years https://en.wikipedia.org/wiki/Voyage_from_Yesteryear

currency for purpose

energy of money