Imputed Production

= Imputed Production is an Organizational Form that strives to Impute all forms of Income.

Discussion

Patrick Anderson:

Capitalism has achieved much for humanity, but as any business scales in size it becomes clear the goals of that body conflicts with the goals of those it claims to serve.

As society becomes more aware of these troubles, corporations try to hide their goal of Profit because we understand Scarcity keeps Price above cost, and therefore striving to perpetuate Profit is the very basis of the conflict between Production and Consumption.

It may seem there could be no solution since those who traditionally Fund production demand Profit as a Return for the Risk they take. They are operating under the paradigm of "Exchange Value" which requires some amount of scarcity to keep Price above Cost.

...

Let's re-examine our assumptions about who should Fund and therefore Own the Means of Production.

Let's look at the most trivial case of a single person owning a fruit tree for his own benefit.

He must pay all the Costs of ownership, including Wages if he does not do the work himself.

But he cannot pay *more* than Cost, for who would he pay it to?

Profit is defined as Price above Cost but if he does not sell the product, Profit is undefined.

So he Funded that production and Owns those means for the expected return of Product instead of Profit. This was "Use Value" production instead of "Exchange Value". It does not benefit this owner when other orchards fail in the area unless he resorts to selling that which he would have eaten.

...

This is all very obvious and might seem unimportant, but let's push the idea a bit further and see what happens:

Imagine now, instead of a single Funder-Owner-User, we have thousands of such investors pooling Funds toward an orchard.

By attracting potential Users to pre-pay for the goods they predict they will need, we can use those Funds to buy the means necessary for that production.

The Users and Owners will then be the very same set. The product will not be sold because the ROI for the Risk is Product itself which they attain at Cost.

...

This solves the 'static' case where the number of Users matches exactly the output of that production.

But many of these consuming investors will want to over-own by some percentage to guarantee they have enough product at the round of each production.

We must do something with that surplus or it will rot.

We can sell those products for Price above Cost - as much as the market will bear - but to keep the organization owned by the Users of those products, we must treat the payment of Profit as an investment from the User who paid it so they also gain ownership in the Physical Sources of production.

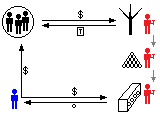

In the attached picture "Capitalism.png" we see investors in the upper-left corner funding production and receiving Title to those Physical Sources.

All Costs, including Worker wages, are initially paid from that pool of funding.

The Consumer (in blue) begins to paying for those Costs in his (late) quest to buy Objects.

Over time, if the business is successful, the investors receive all they had initially put forward and then begin receiving the special value called Profit.

The Consumer never gains any ownership in his own Physical Sources under this arrangement.

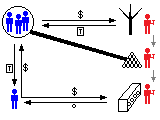

In the attached picture "Patched-Capitalism.png" we see again see investors in the upper-left corner funding production and receiving Title to those Physical Sources, but this time the investors are *also* Consumers of the future product. They are taking risk for the purpose of receiving at-cost Product under their full control.

After each round of Production, the Objects are not sold (except in cases of surplus), because they are already the property of those who will consume them.

The heavy line indicates there is no transfer of ownership, but shows the funders are already the owners without any need to purchase since they paid all the Costs of production and are the owners as a side-effect of their owning the Physical Sources.

The bottom of the picture shows a Consumer with insufficient ownership buying Objects late and probably paying Price above Cost.

But in this case, that overpayment is treated as an investment from the Consumer who paid it - causing him to unwittingly Fund the purchase and care of even *more* Physical Sources that will eventually begin producing and therefore provide him with that which he needs.

This allows the organization to grow and yet remain distributed as all new ownership is 'reflected' back to those willing to pay for that growth.

Seeking At Cost Goods and Services finally under 'our' full control:

.) Avoid paying Economic Rent when renting Physical Sources when you have sufficient ownership in those Physical Sources*

.) Avoid paying Profit for Consumable Goods when you have sufficient ownership in those Physical Sources* used to Produce those Goods.

.) Avoid paying Interest on Money when you Issue instead of Borrow.

.) Avoid paying Wages when you do the Work yourself.

(*) This only occurs during perfect 'sufficiency'. Any Scheduling conflict might trigger an auction, and then bidding will drive Price Above Cost.

Most countries, such as the United States, only tax imputed income in certain situations, such as the calculation of domestic partner employee benefits. It is sometimes difficult to measure, and there can be political consequences to doing so. From the perspective of taxpayers, this creates a tax benefit in favor of owning over renting, and in favor of self-service over hiring. From the perspective of the economy, this distorts economic activity away from activities that are associated with the division of labor. -- http://Wikipedia.org/wiki/Imputed_income

- NOTES* when Developers are supported through the Basic Outcome provided they will have time to apply Skill as Play so our Costs will fall even further.