Common Company

Common Company

Description

The 6 points defining what a Common Company is

Source:

- http://namzezam.wikidot.com/blog:38#comcom

- https://comcomized.com/term-and-conditions/

- http://iswith.wikidot.com/common-company-in-6-points

(licensed under Creative Commons Attribution-NonCommercial 3.0 License)

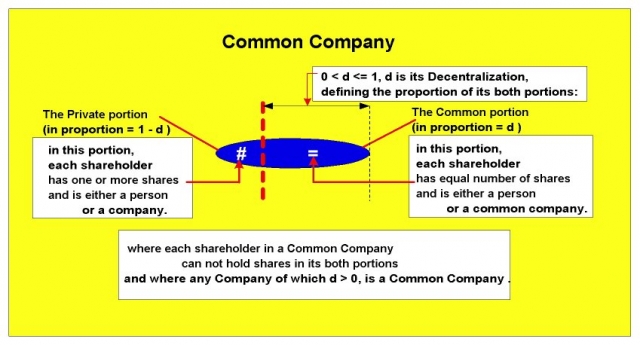

1. It is a commercial company having 2 divisions of shares, namely: the Common and the Private;

2. The proration of shares in its Common division is defined by its Decentralizing property (the d), but only when d is nonzero smaller or equal one (0 < d <= 1) and as d may be set, or reset form zero, but only once in the lifetime of the company, otherwise, when d is zero or reset more then once, then the company is a Private and not a Common one. Hence the d alone defines any company as either Private or Common one;

3. Each of its shareholders is either a Common shareholder or a Private shareholder, respectively to the division of shares the one holds, (Hence a shareholder can never be a Private and a Common shareholder);

4. Each of its common shareholders has equal number of shares and is either a person or a Common Company. Hence a private company can never be a common shareholder in a Common company, but the other way around is possible. This establishes the asymmetric property of the Common companies versus the Private ones in general, for protecting the motion of the notion of decentralizing in the market as a whole;

5. Its total reflected value (the t), being the value of all the shares in the company, is always calculated such that t * d = v * c, where

- t * d is the value of the common division of the company, which is equal to the value of all the Common Shareholders in the company;

- Only when this equation is evaluated true, then the distribution of shares in the company may be considered as such which reflects the t as the projected value of the company, hence all the 4 following equations must also evaluate true:

* t * d = v * c * v = n * s * s = t / i * n = ( i * d ) / c

- and where

* i is the number of ALL issued shares of the company;

* t is the Total projected value of the company, which is the value of ALL its shares;

* s is the price of one Share in the company, it is an offer for sell, which affects directly the t and hence all other reflected values in the company;

* d, as 0 < d <= 1, is the proration of shares in the Common division of the company, which defines the factor of the Decentralizing property of the company, where this factor is static when the company is a Common one;

o c is the number of ALL Common shareholders in the company;

o v is the reflected value held by EACH Common shareholder;

o n is the number of shares held by EACH Common shareholder;

and

6. It is established by an agreement, prior to any other agreement between any of its shareholders, including any other potential such shareholders, where each of the shareholders agrees

- that the number of shares owned by EACH Common Shareholder always equals n,

* where n=(i*d)/c;

- that with each entry of a new common shareholder:

* n is reset to n*(c/(c+1)) and s is reset to s*((c+1)/c)), * then c is reset c+1 and t is set to s*i;

- and that with each departing of an current common shareholder:

* n is reset to n* (c/(c-1)) and s is reset to s*((c-1)/c)), * then c is reset c-1 and t is set to s*i.